d by Egon von Greyerz via GoldSwitzerland.com,

The world is now witnessing the end of a currency and financial system which the Chinese already forecast in 1971 after Nixon closed the gold window.

Again, remember von Mises words: “There is no means of avoiding the final collapse of a boom brought about by credit expansion.”

History tells us that we have now reached the point of no return.

So denying history at this point will not just be very costly but will lead to a total destruction of investors’ wealth.

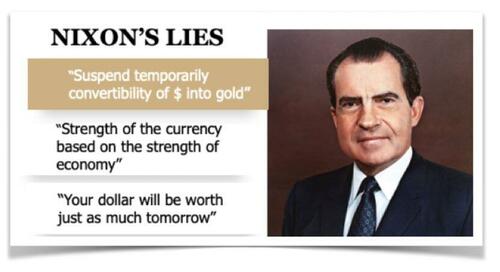

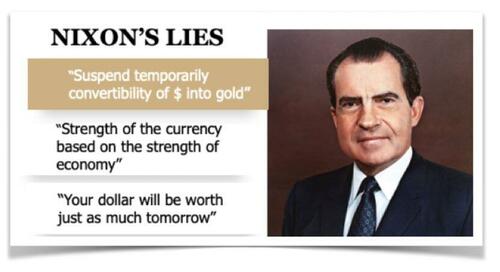

POLITICIANS LIE WITHOUT FAIL

History never lies but politicians do without fail. In a fake system based on false values, lying is considered to be an essential part of political survival.

Let’s just look at Nixons ignorant and irresponsible statements of August 15, 1971 when he took away the gold backing of the dollar and thus all currencies.

Later on we will show how clearsighted the Chinese leaders were about the destiny of the US and its economy.

So there we have tricky Dick’s lies.

The suspension of the convertibility of the dollar in 1971 is still in effect 52 years later.

As the dollar has declined by almost 99% since 1971, the “strength of the economy” is also declining fast although using fiat money as the measure hides the truth.

And now to the last lie: “Your dollar will be worth as much tomorrow”. Yes, you are almost right Dick! It is still worth today a whole 1% of the value when you closed the gold window.

The political system is clearly a farce. You have to lie to be elected and you have to lie to stay in power. That is what the gullible voters expect. The sad result is that they will always be cheated.

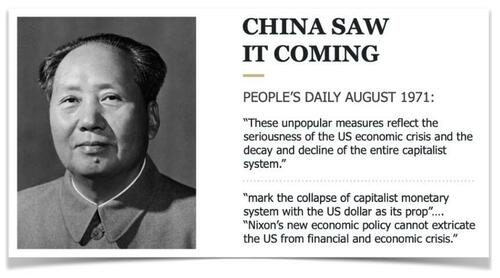

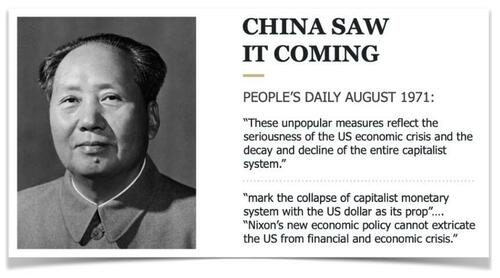

CHINA FORECAST THE CONSEQUENCES ALREADY IN 1971

So in 1971 after Nixon closed the gold window, China in its official news media the People’s Daily made the statements below:

Clearly the Chinese understood the consequences of the disastrous US decision which would destroy the Western currency system as they said:

Seriousness of the US economic crisis and decay and decline of the capitalist system

Mark the collapse of the monetary system with the US dollar as its prop

Nixon’s policy cannot extricate the US from financial and economic crisis

I am quite certain that the US administration at the time ridiculed China’s official statement. As most Western governments, they showed their arrogance and complete ignorance of history.

How right the Chinese were.

But the road to perdition is not immediate and we have seen over 50 years the clear “decline of the capitalist system”. The end of the current system is unlikely to be far away.

Interestingly it seems that a Communist non-democratic system is much more clairvoyant than a so called Western democracy. There is clearly an advantage not always having to buy votes.

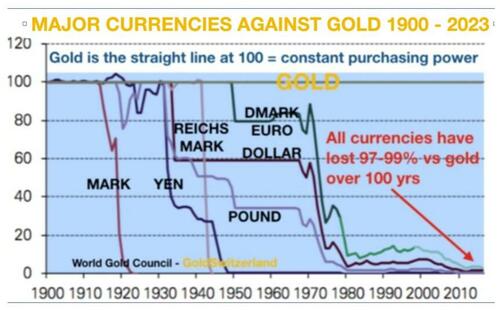

IRRELEVANT WHICH CURRENCY WINS THE RACE TO THE BOTTOM

As the whole currency system is about to implode, it is in my view totally irrelevant where the US dollar is heading short term measured against other fiat currencies.

The dilemma is that most “experts” use the Dollar Index (DXY) as the measure of the dollar’s strength or weakness. This is like climbing the ladder of success only to find out that the ladder is leaning against the wrong building.

To measure the dollar against its partners in crime (the other fiat currencies) misses the point as they are all on the way to perdition.

So the dollar index measures the dollar against six fiat currencies: Euro, Pound, Yen, Canadian Dollar, Swedish Kroner and Swiss Franc. The Chinese Yuan shines in its absence even though China is the second biggest economy in the world.

But here is the crux. The dollar is in a race to the bottom with 6 other currencies.

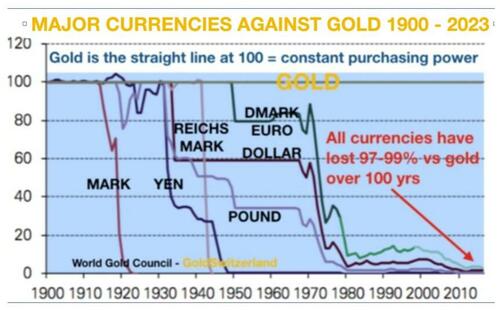

Since Nixon closed the gold window in 1971 all 7 currencies, including the US dollar, have declined 97-99% in real terms.

Real terms means constant purchasing power.

And the only money which has maintained constant purchasing power for over 5,000 years is of course gold.

So let’s make it clear – the only money which has survived in history is GOLD!

All other currencies have without fail gone to ZERO and that without exception.

Voltaire said it already in 1729:

PAPER MONEY EVENTUALLY RETURNS TO ITS INTRINSIC VALUE – ZERO

And that has been the destiny of every currency throughout history.

Every single currency has without fail gone to ZERO. And this is where the dollar and its lackeys are heading.

To debate if a currency, which has fallen 98.2% in the last 52 years, is going to strengthen or weaken in the next year or two is really missing the point.

It is virtually 100% certain that the dollar and all fiat money will complete the cycle (which started in 1913 with the creation of the Fed) and fall the remaining 1-3% to ZERO.

But we must remember that the final fall involves a 100% loss of value from today.

BRENT JOHNSON & MATT PIEPENBURG DEBATE THE DOLLAR

So to debate whether the dollar index which today is 103, will reach 150 first as my good friend Brent Johnson argues in his Dollar Milk Shake Theory or that it will fall from here as my colleague Matt Piepenburg contends, really misses the point.

There is no prize for coming first to the bottom. The dollar is down almost 99% in real terms since 1971. So it has a bit over 1% to fall to reach ZERO.

And history tells us that the final fall is INEVITABLE.

So why worry if the Dollar or the Euro becomes worthless first? It really is a mute point.

Brent Johnson and Matt Piepenburg recently had a debate on Adam Taggart’s new platform “Thoughtful Money”. Adam is an outstanding host with great speakers and both Brent and Matt were superb in their presentation of the arguments for or against the dollar. But even though they both like and understand gold, they got a bit too caught up in the dollar up or down debate rather than focusing on the only money which has survived in history. Still, I know that they both appreciate that gold is the ultimate money.

NOT ALL CURRENCIES ARE BAD

The world’s reserve currency has had a sad performance based on lies, poor real growth, all due to a mismanaged economy based on debt and printed money.

So although most currencies have lost 97-99% in real terms since 1971 there are shining exceptions.

When the gold window was closed in 1971 I was working in a Swiss bank in Geneva. At the time, one dollar cost Swiss Franc 4.30. Today, 52 years later, one dollar costs Swiss Franc 0.88!

This means that the dollar has declined 80% against the Swiss Franc since 1971.

So a country like Switzerland with virtually no deficits and a very low debt to GDP proves that a well managed economy with very low inflation doesn’t destroy its currency like most irresponsible governments.

The Swiss system of direct democracy and people power is totally unique and gives the people the right to have a referendum on almost any issue they choose.

This makes the people much more responsible in their choices as a winning vote on any issue becomes part of the constitution and cannot be changed by government or parliament. Only a new referendum can change such a decision.

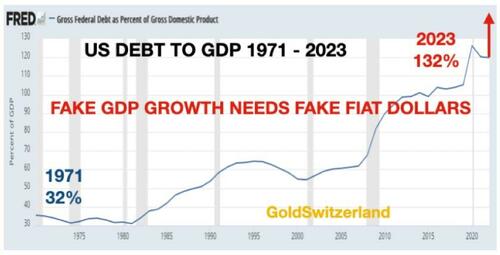

THE US BANANA REPUBLIC

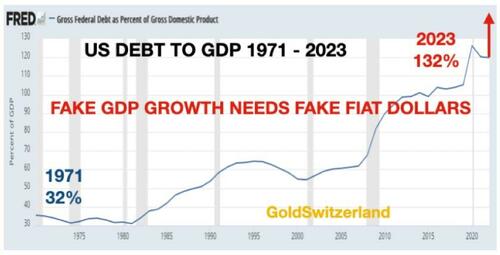

Swiss Debt to GDP is around 40%. This was the level of US debt back in 1971 before the gold window was closed.

As the graph below shows, US debt to GDP is now 132%. In 2000 it was 55%.

132% debt to GDP is the level of a Banana Republic which is frantically trying to survive by printing and borrowing ever increasing amounts of worthless fiat money.

So debt to GDP is now reaching the exponential phase. I have explained the final phases of exponential moves in many articles like here.

Since there is no intent or possibility to reduce the US deficit, the likely deficit for next fiscal year is most probably in excess of $2 trillion and that is before any bad news like higher inflation, higher interest rates, bank failures, more war, more QE etc.

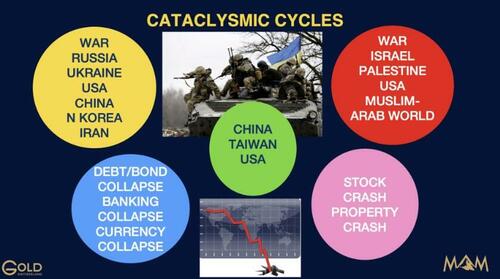

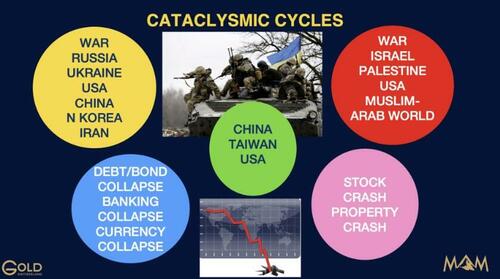

As I discussed in a recent article,“THE CYCLE OF EVIL”, the world is today facing unprecedented risks of a magnitude never before seen in history.

THE TIME TO PRESERVE WEALTH IS NOW

The combination of geopolitical and financial risk makes wealth preservation an absolute necessity.

Most asset markets look extremely vulnerable be it stocks bond or property. Few investors understand that current asset prices are in cloud cuckoo land as a result of an unprecedented credit expansion.

Personally I think we are now at a point when asset markets could tank.

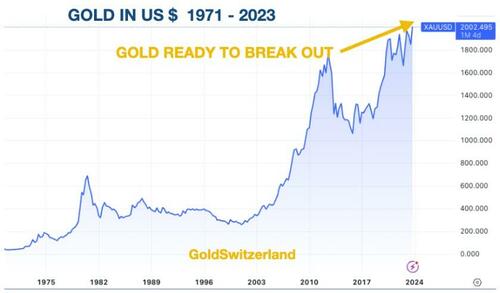

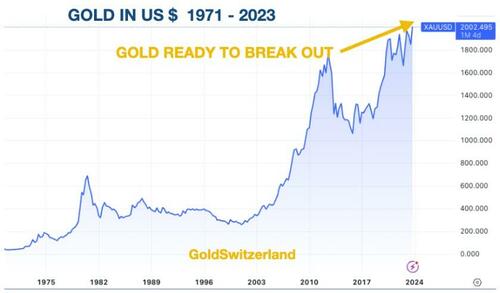

At the same time gold looks ready to soon break out of its consolidation since 2020.

Once gold leaves the $2,000 level behind, the move is likely to be fast.

Silver will most probably move twice as fast as gold.

But this is not a question of price and speculation. No, it is all about risk and wealth preservation.

So short term timing is irrelevant. The next few years will be about financial survival.

Sadly most investors will buy the dips in conventional asset markets like stocks and lose most of their gains in the last few decades.

As gold is insurance against a rotten financial system it must be acquired and owned outside a fragile banking system which is unlikely to survive in its present form.

Here are a few of the SINE QUA NON (indispensable conditions) for gold ownership:

Gold must be held in physical form. No funds, ETFs or bank held gold.

The investor must have direct access to his own gold bars/coins.

Any counterparty must be eliminated whenever possible.

Gold must be stored in ultra safe vaults outside the banking system.

Gold should not be stored in a major city.

Gold must be insured.

Only gold that you are prepared to lose should be stored at home.

Gold should be stored outside your country of residence and in a gold friendly jurisdiction.

The country where the gold is stored must have a long history of democracy, political stability and peace.

As we are approaching one of the most precarious times in history both financially, socially, politically and geopolitically, Wealth Preservation in the form of gold and some silver will make the difference between financial survival or ruin.

As always, most important in life is looking after family and helping friends.

And remember that in the difficult times ahead there are many wonderful things that are free like nature, books, music, sports etc.

https://www.zerohedge.com/markets/von-greyerz-financial-system-has-reached-end