Welcome to debt-serfdom, the only possible output of the soaring cost of living.

Long-time readers may recall the Burrito Index, my real-world measure of inflation. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016). The Burrito Index tracks the cost of a regular burrito since 2001. Since we keep detailed records of expenses (a necessity if you’re a self-employed free-lance writer), I can track the cost of a regular burrito at our favorite taco truck with great accuracy: the cost of a regular burrito has gone up from $2.50 in 2001 to $5 in 2010 to $6.50 in 2016.

It's time for an update: the cost of a regular burrito has now reached $7.50, triple the 2001 cost. That's a 200% increase in 17 years. According to the federal government, inflation since 2001 has risen about 40%: what $1 bought in 2001 now costs $1.43, according to the BLS Inflation calculator.

The Burrito Index is five times the official inflation rate. As I noted in The Disaster of Inflation--For the Bottom 95% (October 28, 2016) and Inflation Isn't Evenly Distributed: The Protected Are Fine, the Unprotected Are Impoverished Debt-Serfs (May 25, 2017), the gross under-reporting of inflation (i.e. the loss of purchasing power of "money" and labor) is only part of the distortion: some of the populace is protected by subsidies from the real ravages of inflation, while those exposed to the unsubsidized real-world costs are being savaged by supposedly benign inflation.

Lest you reckon only burritos have tripled in cost since 2001--have you checked out college tuition or rents lately? Consider a typical public university:

University of California at Davis:

2004 in-state tuition $5,684

2018 in state tuition $14,463

2004 in-state tuition $5,684

2018 in state tuition $14,463

So tuition at a state university soared 2.5 times while official inflation rose by a mere 35% since 2004. If UCD tuition had only risen by 35%, it would total $7,673, not $14,463. The cost above and beyond what we would expect had tuition tracked official inflation adds up to $27,000 per four-year bachelor’s degree per student. Now multiply that by millions of college students, and you get a sense of the enormity of the gulf between real-world inflation and the official inflation rate of 2.5% annually.

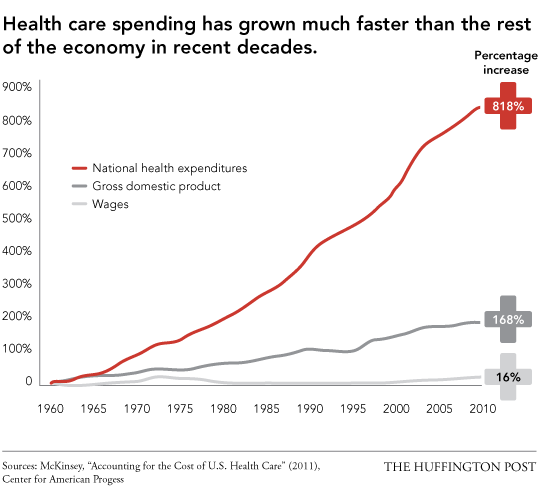

In regions with hot job markets, rents have doubled since 2001. As for the unsubsidized costs of healthcare insurance: many of those paying the unsubsidized costs would be happy if their premiums had only doubled since 2001:

But the cost of health care is a growing burden for MCS and its 170 employees. A decade ago, Master said, an MCS family policy cost $1,000 a month with no deductible. Now it’s more than $2,000 a month with a $6,000 deductible. MCS covers 75 percent of the premium and the entire deductible. Those rising costs eat into every employee’s take-home pay.

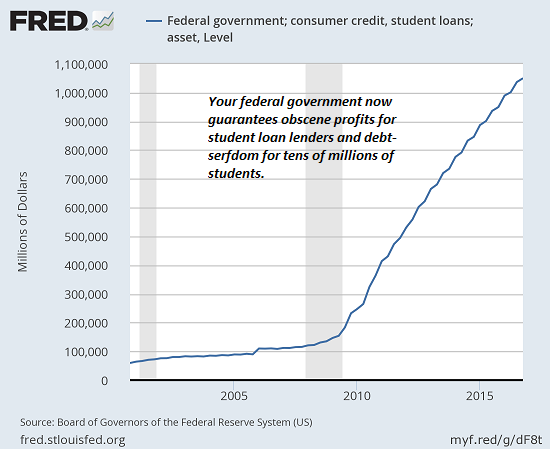

And here's how the bottom 95% of American households pay for soaring tuition/fees: with borrowed money:

Welcome to debt-serfdom, the only possible output of the soaring cost of living for the unprotected who are ruled by a hubris-soaked, Protected Elite. Our job is to shoulder the higher prices by taking on more debt--debt which is immensely profitable for the Protected Elite.

Here's what you're supposed to swallow: big-ticket expenses such as rent, healthcare and higher education cost tens of thousands of dollars more, but TVs cost a few bucks less, and as a result, official inflation is 2.1% annually.

As long as we accept this travesty of a mockery of a sham, we deserve what we get.

My new book Money and Work Unchained is $9.95 for the Kindle ebook and $20 for the print edition.

My new book Money and Work Unchained is $9.95 for the Kindle ebook and $20 for the print edition.

Read the first section for free in PDF format.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

http://charleshughsmith.blogspot.com/2018/05/burrito-index-update-burrito-cost.html