As cities burn and statues topple, the Nasdaq races to all-time highs. As unemployment explodes to levels not seen since the 1930s, gambling on dicey stocks soars. As private property becomes less secure, titles to property are bid higher. As businesses struggle to reopen, it’s business as usual for the great bull market in financial assets.

If

the statisticians at the CDC are to be believed, 0.01% of the U.S.

civilian labor force has died of the coronavirus in 2020. For a risk that

compares to driving an automobile, much of the population was scared out of

their wits and a third of the economy put on life support.

The

Big Lie

Official

narratives have proven far more contagious (and lethal) this year than any

virus, and the supporting lies keep getting bigger. Upon arrival of an

unknown health risk in late February, the authorities promoted a top-down

one-size-fits-all solution of universal isolation. The centralization of

knowledge was assumed and market solutions not even considered. As

“non-essential” businesses were shut down, corporate debt markets locked up and

stocks lost one-third of their value. To deal with the economic mess,

only top-down government solutions saw the light of day, this time at a price

tag of over $5 trillion in borrowed and printed money (with plenty more on the way).

With

the death of George Floyd on May 25, caught on video for the world to see, the

narrative shifted overnight from gray lives matter and “shelter in place” to

“black lives matter” and protest in public. Never mind that Floyd had

enough fentanyl in his body to kill him and that

the officers on the scene may have acted to save him. The mainstream media

went into overdrive, promoting the well-rehearsed narrative of systemic

racism. Keep in mind, 30% of the top 30 highest-paying celebrity endorsements last year went to blacks

(even though they account for 13% of the population). Consumers generally

don’t buy products endorsed by people they hate.

Swing,

GordonBuy New $17.94(as of 04:16 EDT - Details)

The third act in this play,

reopening the economy, was met with fearmongering over spiking cases, despite

evidence that this was due largely to increased testing and inflated by false

positives. (Apparently crowds looting and setting cars on fire were not a

factor.) Meanwhile, the weekly death rate has dropped 60% from its peak

in April. (Over the past week, there were 7,200 official deaths vs.

250,000 recoveries.)

All three deceptions are

wrapped in the biggest of lies, that government has a magic printing press that

will suspend the laws of economics and make it all go away.

Day

trading madness

As it turns out, a fair

amount of the stimulus money found its way into the financial markets.

Evidently, the government’s economic advisors failed to consider the

possibility that shutting down casinos while ordering people to remain home and

mailing them $1,200 checks might give the green light to pile into the only

casino still open: the stock market.

August 15, 2020

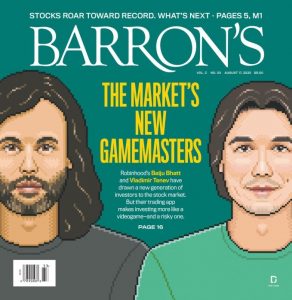

Speculation

took off, especially among younger investors. Robinhood, favored by

millennials, added 3 million accounts in the first quarter alone.

(Charles Schwab has 14 million accounts in total.)

According to CNBC,

Robinhood traders lived up to

their outlaw name during the coronavirus market downturn. The young investors

booked profits — trading stocks with some of the best returns in the past two

months — while other Wall Street veterans were left scratching their heads.

Tempting the investment gods,

CNBC flattered youth and mocked experience:

Young investors… appeared to

have a prescient understanding of the market, unlike the billionaire hedge

fund managers who said stocks would retest their lows. Longtime investor

Stanley Druckenmiller — who misjudged equities’ comeback —

said Monday that the market’s strong performance over the last three

weeks has “humbled” him and that he underestimated the power of the Federal

Reserve. Even legendary investor Warren Buffett sold his stake in

airlines during the pandemic.

In the Twittersphere, the day

trading parade is led by Dave Portnoy with 1.6 million followers:

I

play the stock market like I play Monopoly. If I land on it, I’m buying

it. I don’t care if it’s Baltic, I don’t care if it’s Park Ave…

When I land on “Pass Go,” I try to buy Go. When I land in jail, I’m like,

can I buy jail?… I just buy, buy, buy. That’s how I do stock market,

that’s how I play Monopoly.

It’s

hard not to laugh, but also to know what passes for parody and actual

investment advice these days. Davey Day Trader, #DDTG, was recently

invited to spend 20 minutes interviewing President Trump at the White

House as both celebrated buying the dip in March. You can’t make this up.

How

to wreck an economy

2020 has been a textbook

example of how to inflict maximum economic damage. Let’s review:

1)The media incites a panic

over a severe novel case of the flu. Have state governors use this as a

pretext to shut down a third of the economy.

2) With the social fabric

frayed, the media segues to racial protests. Allow bad apples to destroy

property and have the police stand down while the mob takes over.

3) Pass trillions in money

printing and stimulus, preventing the market from adjusting to rapidly changing

events. Incentivize unemployment by paying people an extra $600 a week to

sit at home and day trade.

4) Unwittingly turn

speculators loose, sending false signals to economic actors.

5) After you’ve crippled many

small businesses with #1-4, regulate them to death, adding costs they can’t

afford and inconveniences their customers don’t want.

Déjà

vu all over again

Anyone who experienced the

tech bubble of the late 1990s must be feeling a profound sense of déjà

vu. The internet was a paradigm shift creating a New Economy in which

enlightened central bankers would prevent any serious downturn. Silicon

Valley was booming. Wall Street was cranking out hot IPOs (initial public

offerings) and repackaging companies by adding “.com” to the name in order to

keep up with seemingly insatiable demand from the public.

The prevailing mood among

investors was that making money was easy. Youth was elevated and wisdom

discarded. Profits didn’t matter. What mattered was “first mover

advantage” and “eyeballs.” Those who were too old to grasp the new rules

just didn’t “get it.” They were stuck in the Old Economy.

February 22, 1999

I

remember when the late Ed Bradley of 60 Minutes did

a story about the dot-com mania. The young entrepreneurs he interviewed

had a religious zeal, like they had been chosen for a higher calling. One

even had the audacity to tell Bradley he was a dinosaur and that his job was

targeted for extinction.

Andrew

AzizBest Price: $8.92Buy New $12.91(as

of 04:16 EDT - Details)

It is hard to escape the

parallels with today’s mania for technology stocks, venture capital, day

trading, hot IPOs and youthful exuberance. There are two critical

differences: the backdrop for the 2000 vintage was a booming economy and the

dollar amounts were much lower. In 2000, Microsoft, GE and Cisco Systems

broke the $500 billion barrier for market capitalization. On August 13,

Apple hit $2 trillion.

Perhaps

it is a rite of passage that every generation must take part in some sort of

speculative madness. Today’s millennials seem ideologically wired to

believe in the upward slope of technological progress, conflate virtue signaling with investing,

underestimate the economic damage from trillions of dollars of stimulus, and

place their unswerving faith in the Fed.

Tesla

has become the poster child of the millennial bubble, p.c. bubble, EV bubble

and VC bubble. Its stock commands a market value of $412 billion, more

than BMW, Daimler, Volkswagen, Toyota and General Motors combined.

Believe it or not, some traders are actually confusing Tesla (symbol “TSLA”) with

micro-cap Tiziana Life Sciences (symbol “TLSA”).

Of course, amateur hour at

the casino has a silver lining. Experienced poker players salivate when

the patsies show up.

(This

article was excerpted from the latest issue of The

Coffee Can Portfolio.)

Kevin Duffy [send him mail] co-founder, Bearing Asset

Management and editor of The Coffee Can Portfolio and Notable

and Quotable blog.

https://www.lewrockwell.com/2020/08/kevin-duffy/the-robinhood-rally-2/