Submitted by Larry McDonalds, author of The Bear Traps Report

Over the last 30 years looking at markets, there are periods

when things happen so fast millions are left in a previous mindset, not fully

comprehending the world has changed in a secular fashion, NOT cyclically.

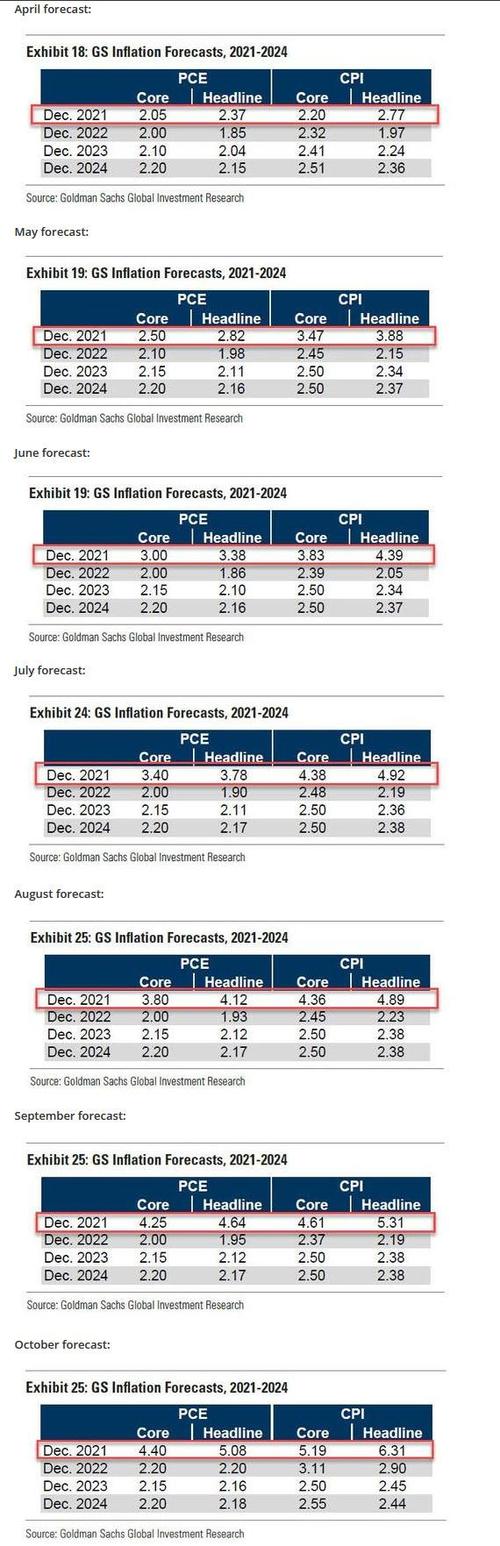

In April, Goldman Sachs was looking for tame CPI inflation by December 2021. That's right, the best and brightest told us core would be 2.20% and headline data of 2.77% was coming. Today, they brought out the eraser with a forecast of 5.19% and 6.31%.

Over the last 30 years looking at markets, there are periods when things happen so fast millions are left in a previous mindset, not fully comprehending the world has changed in a secular fashion, NOT cyclically.

"There are decades where nothing happens, and there are weeks where decades happen” Vladimir Ilyich Lenin reminds us. Years and years of inflation without a pulse has changed human behavior in such a profound way, a true complacency overdose took over.

Over the last 18 months, from Beijing to Tokyo, to Berlin to Washington no amount of fiscal spending has been unacceptable. Debt monetization via central banks, MMT (modern monetary theory) has moved from “taboo” to “bring it on” territory.

Looking forward, every hour, minute and second of each day more and more market participants are waking up to the new reality of sustained inflation. On the Sunday talk shows, U.S. Treasury Secretary Janet Yellen threw the inflation blame on the pandemic and is essentially making the point that rate hikes are NOT needed once the pandemic is over inflation will disappear is the argument.

This is HIGHLY BULLISH gold and silver miners. In our view, Yellen is using public forums to lay out the future Fed policy path. There is NO QUESTION Yellen has President Biden's ear and if Fed Chair Powell wants the job, he must fall in line.

Interest costs to taxpayers have nearly doubled ($562B) since 2000 with interest rates/bond yields falling from near 7.0 % to 1.5%. How much pressure is on the Fed to further monetize debt 2022-2030??

Extreme measures. CPI is normalizing at a much higher trajectory, that’s all that matters for consumers.

We are in mass "Jonestown" delusion territory. Over $100T of the planet's wealth is positioned in bonds sub 2% in yield with inflation normalizing this cycle at 3-4% vs 1-2% post Lehman.

It’s mind boggling that people are focused on YoY inflation coming down, of course, it will, that's irrelevant . All that matters is when does inflation come back to the 2010-2020 norm? If that is 5 years from now, trillions of dollars of assets are in the wrong place.

Corporations are making more money than ever while inflation is at multi decade highs which in turn is causing a sharp decline in real wages. Hard to imagine a better recipe for coast to coast labor strikes.

The Fourth Turning will be characterized by open conflict between the management class and labor. Unions will grow their ranks. The strike at Deere has farmers scrambling for used tractors and tractor parts.

Prices increased by 9.5% in the 3rd quarter, as per The Machinery Pete Used Values Index, the keepers of which predict higher increases 4th quarter. As a result the planting season will be more expensive. Those increased costs will be passed on to the consumer. This will cause the price of food to be higher.

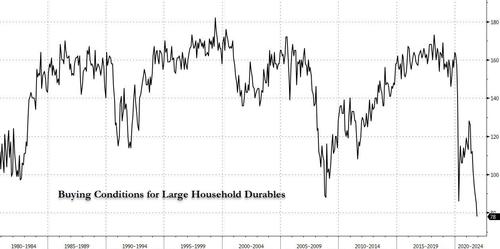

There is no greater exercise of the power of labor than a work strike. And we see here how it causes inflation. Worse than 2008-2009, UMich Buying Conditions for large Household Durables , “furniture, a refrigerator, stove, television, and things like that “ printed at 78 last week vs. 112 last year and as low as 98 during the 2008 financial crisis. U.S. demand destruction from inflation is near unprecedented levels.

Bullish gold and silver yields on 10 year inflation indexed Treasuries are at their most negative in twenty+ years as investors expect the economy to continue shrinking in real terms. The last time the Fed hiked rates 2015-2018, these yields ranged from a positive +0.05% to +1.2% vs today at -1.2%.

S&P 500 earnings growth expectations do not jive with real evidence of demand destruction; discussing the record PEG level, BofA says that "today’s level would suggest losses of -20% over the next 12 months based on the historical relationship."

It is a "deer in the headlights" moment for the Street. After buying the Fed's "transitory" narrative for nine months, the Street still has 2021, 2022, and 2023 S&P 500 earnings growth per share up in the clouds. Bonds are screaming growth is plunging as demand destruction is taxing consumers and profits, but the Street just took up their numbers bigly! They missed 2020 by a country mile on covid (understandable), and then lowballed their 2021 outlook in Q1 this year, then they took 2021, 2022, and 2023 numbers UP 20% 25% higher over the summer. Then inflation becomes NOT transitory.

This is a screaming sell signal.

As inflation has proved more sustainable, U.S. tech stocks have a near term date with an elevator shaft. Hard assets > financial assets 2020-2030.

https://www.zerohedge.com/markets/we-are-mass-jonestown-delusion-territory