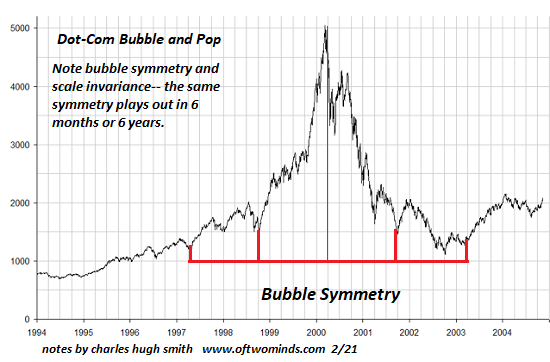

And what happens next? Bubble symmetry: valuations fall at the same rate as they rose, declining back to the starting point over a roughly equivalent time duration.

All speculative bubbles share certain traits: the abandonment of caution, the euphoria of seemingly endless gains, the eventual re-connect with reality (i.e. the bubble pops) and bubble symmetry as the waterfall decline mirrors the euphoric ascent.At the same time, the specific origin and nature of each bubble is unique to its era and circumstance. The housing bubble that popped with such devastating consequences in 2007-08 was the result of the vast expansion of subprime mortgage lending which began as a progressive goal of expanding home ownership to the lower-middle class by lowering credit standards.

This ideal quickly morphed into the explosive growth of entire industries exploiting this new pool of subprime borrowers via outright fraud: no-document loans (a.k.a. liar loans), negative interest mortgages, interest-only mortgages, etc., all fueled by the packaging of guaranteed-to-default mortgages in mortgage-backed securities fraudulently veneered with a low-risk rating issued by captured ratings agencies.

The rock that starts the landslide doesn't have to be all that large. The entire subprime mortgage sector was a relatively modest percentage of the mortgage market and a tiny slice of the global financial system, but it is the nature of bubbles to be a pyramid house of cards in which the entire bubble is based on debt expanding on the supposedly solid foundation of rapidly rising collateral: the McMansion that sold for $300,000 a few months ago has doubled in value and now supports a $500,000 mortgage.

The delighted speculator takes the "free money" $200,000 and buys another McMansion, and so on, pyramiding the first house into a mini-empire of homes, all gaining value as the bubble expands. This virtuous feedback expands housing valuations, collateral and debt that is deployed to buy more homes.

Then the feedback loop reverses. Once the bubble pops, valuations decline, collateral diminishes and eventually all the mortgages are underwater, i.e. unsupported by collateral. At the same time, income generated by the assets declines, making it difficult for the owner to service the debt, which perversely, remains the same as valuations plummet.

This time around, the source of the bubble isn't subprime buyers, it's wealthy investors and corporations using "excess savings" and easy credit to snap up homes and rental apartments as "safe" places to park their excess capital. Excess savings is in quotes because the "excess" money isn't savings per se, it's unearned gains generated by buying assets long ago at low rates of interest. As valuations soared, the wealthy owners of capital have been "burdened" with the task of where to park all these massive gains.

Macro-economists reference this "excess savings" as a problem without exploring the reality it's only the top 5% which have this "problem": as many have documented, the vast majority of the gains generated by the economy/assets have accrued to the top 5% who bought assets early in the cycle and used their skills, connections and capital to skim most of the income gains as well as most of the capital appreciation.

Globalization and financialization concentrated the economy's gains in corporations, which also gained the "problem" of what to do with all this "excess savings." One popular choice is use the money to buy back shares, an "investment" that boosts earnings per share by reducing the number of shares outstanding and that accrues to shareholders and those managers who have outstanding stock options based on the value of shares.

Both the wealth 5% and corporations also had access to low-cost credit. Ample incomes, substantial assets--these are highly attractive to lenders, and so the best rates are available to the already-wealthy who can then tap this credit to buy assets which yield higher returns.

Real estate is a favored place to park "excess capital" globally for three reasons:

1. As a general rule, it's a stable, lucrative source of income via rents, either long-term or short-term vacation rentals (Airbnb).

2. Real estate typically has a lower risk profile than assets such as stocks.

3. In eras of expanding credit, leverage and population, real estate typically increases in value as supply is inherently limited by geography and other factors.

The short-term rental craze is an under-appreciated driver of the frenzy to buy homes and flats globally. The top 5% read accounts of owners banking huge incomes from short-term rentals in desirable locales and in response they deployed some of their excess capital/credit to chasing the short-term rental market by buying properties sight unseen.

In hot real estate markets, wealthy buyers snapped up properties to hold for capital appreciation. Since tenants are potential sources of problems, these absentee owners prefer not to bother renting out the flat or house; they purposefully leave it empty since they don't even need a rental income to cover the expenses.

The net result of these pressures to park excess capital in real estate? Hundreds of thousands of empty homes and flats. By siphoning these properties off the market, the wealthy parking excess capital have created artificial scarcities in long-term rentals and "homes for sale," jacking up rents and pushing valuations to the moon.

Corporations have bought up tens of thousands of houses and built or bought tens of thousands of rental apartments to lock in the low-risk returns of collecting rent and capital appreciation.

Note the virtuous feedback for the wealthy: the more properties they own and keep off the market, the greater the upward pressure on rents and valuations, and the greater their income and appreciation.

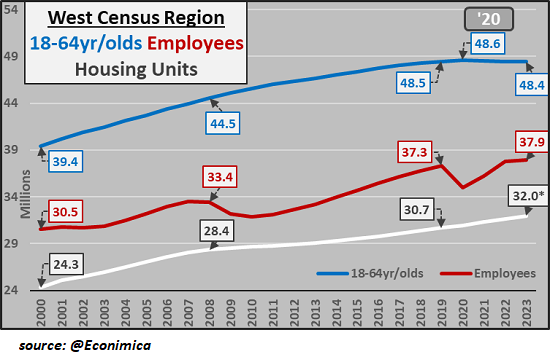

In the first chart below (courtesy of CH @Econimica), note that the population and number of employees 18-64 years of age in the American West remained essentially flat while the number of housing units increased by 1.3 million. And yet there's supposedly a sudden shortage of housing for rent/sale? Any scarcity isn't the result of population growth, it's the result of rentier-investors buying units as investments and holding them off the long-term rental / ownership markets.

There's also a demographic component: the number of young people who can afford to buy a flat or home from the absentee-rentier wealthy / corporate owners has diminished as interest rates have risen and housing prices have soared. In effect, this concentration of ownership in the hands of rentier wealthy and corporations has stripmined the market of conventional household buyers.

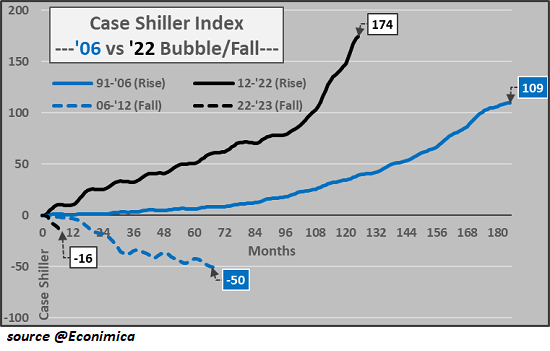

In effect, liquidity has been withdrawn from the real estate market. The wealthy can sell to other wealthy households, but since that's 5% of the populace at best, the market is thin / illiquid. Once selling commences, there are few buyers to support valuations. Illiquid markets are prone to crashes or waterfall declines, a dynamic visible in the chart below of the current housing bubble bust decline.

Though few seem to mention it, housing demand is elastic. People move back home, move in with their adult children, take boarders / roommates, etc. There is no law that says an increasing population guarantees a populace of people who can afford $2,500 rent for a tiny flat or $750,000 for a crumbling bungalow.

In a recession, rents drop. Housing demand slackens and vacancies increase, pressuring rents lower. Once rents drop, valuations follow, as valuations eventually reconnect with the fundamentals of income generated by the asset.

Once prices of houses and flats start dropping, owners can no longer count on appreciation. Suddenly, a low-risk asset acquires a different risk profile: it's losing value, not gaining value.

To lock in gains, the wealthy rentier class and corporations have to sell. Nice, but to whom? Having outpriced households and stripmined the younger generations with sky-high rents, the wealthy and the corporations will discover there aren't enough buyers to support current valuations. Once absentee owners try to sell en masse, the market crashes.

Distortions eventually have consequences. Concentrate wealth and income in the top 5% and corporations, and give the already-wealthy abundant low-cost credit to concentrate ownership of assets, and you get a distorted economy in which the few have outpriced the many and skimmed most of the income.

Who's left to buy overvalued assets? Too few to prop up nosebleed valuations.

And what happens next? Bubble symmetry: valuations fall at the same rate as they rose, declining back to the starting point over a roughly equivalent time duration. (see chart below).

https://www.oftwominds.com/blogapr23/housing-bubble4-23.html?fullweb=1

https://www.oftwominds.com/blogapr23/housing-bubble4-23.html?fullweb=1