During a bull market, imbalances build up that seem scary but are not, in the moment, a deal-breaker. It’s only with hindsight that we look back and say, “Oh yeah, that’s where it started to change.”

This series points out the trends that will — eventually — be the warnings we should have heeded:

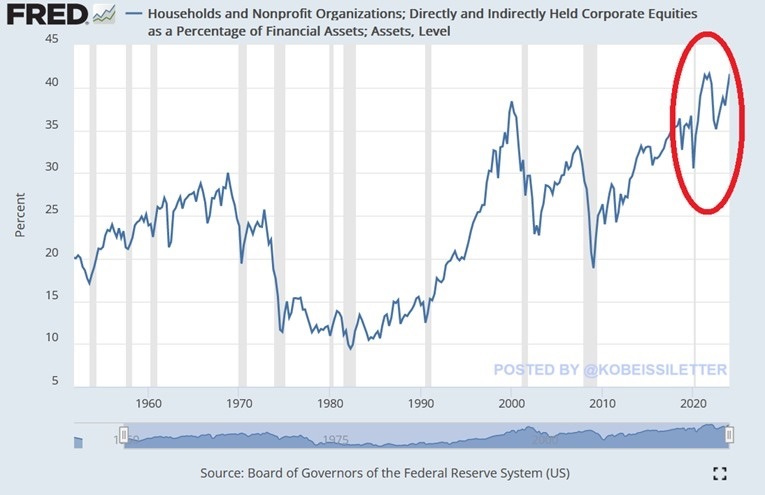

Households are overinvested in stocks

From the Kobeissi Letter:

US households' stock allocation as a percentage of financial assets hit a new record of 41.6% in Q1 2024. This is up from 30.5% in 2020 and even higher than in the 2000 Dot-Com bubble peak of 38.4%.

Since the 2008 Financial Crisis, household participation in stocks has more than DOUBLED. Since then, the Nasdaq has rallied 1,738% and the S&P 500 is up 702%. Since October 2023 alone, the Nasdaq and S&P 500 have seen 40% and 32% gains, respectively.

Households are benefiting from the historic run in stocks.

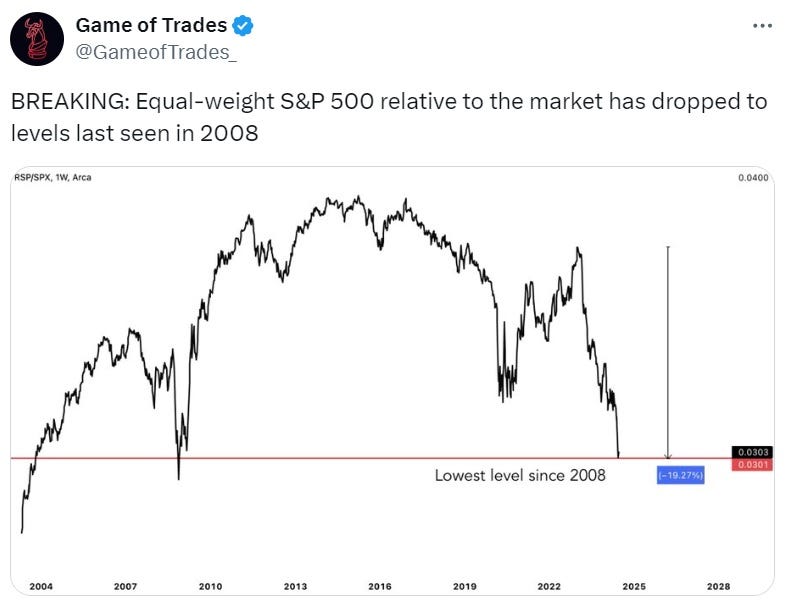

Market breadth is back to Great Recession levels

From Game of Trades:

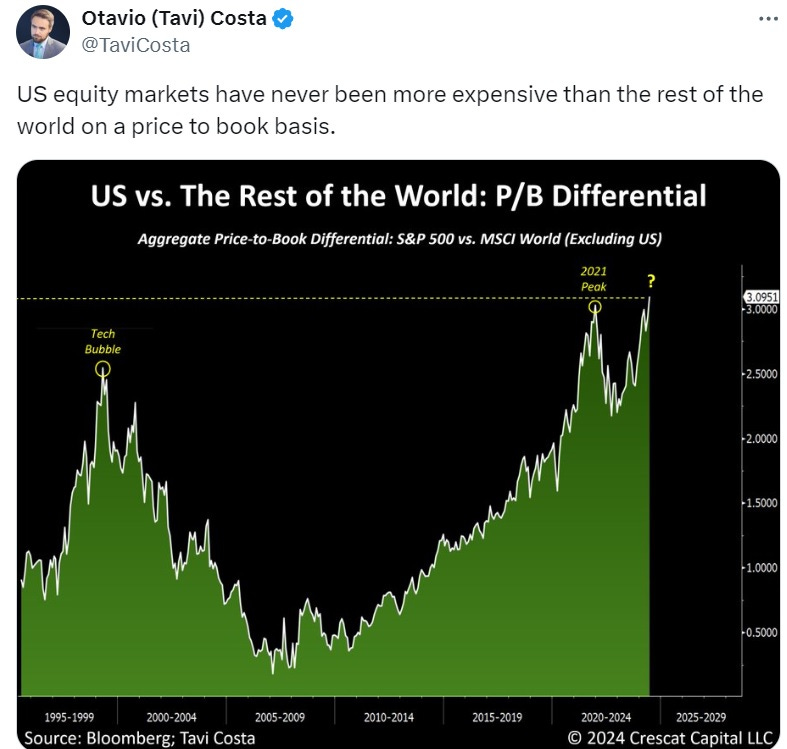

US stocks are expensive compared to the rest of the world

From Tavi Costa:

Overvalued From Any Angle

To sum up, US stock markets are being elevated to historically unusual levels by a handful of high-flying Big Tech companies that face rising competition (Nvidia), slowing growth (Apple) and/or anti-trust scrutiny (Google). And Americans are as heavily invested in those stocks as they’ve ever been. Someday we’ll look back on this as a dangerous combination.