Authored by Egon von Greyerz via GoldSwitzerland.com,

We are now at the end of an era of economic and moral decadence in a debt infested world built on false values, fake money and abysmal leadership. All hell will break loose.

The consequences will be fatal for the world.

There are eras in history which have produced great leaders and thinkers. But sadly, the current era has produced nothing of that kind. The end of an economic cycle produces no great leadership or statesmanship but only incompetent leaders.

Looking at the Western world, the only notable statesman in the last few decades in my view is Margaret Thatcher, prime minister of the United Kingdom from 1979 to 1990.

But political leaders are of course instruments of their time. Sadly times as the current don’t produce Superior Men.

As Confucius said:

“The Superior Man thinks always of virtue, the common man thinks of comfort.”

It is the buildup of a massive debt mountain which has given the Western world a false comfort based on false values.

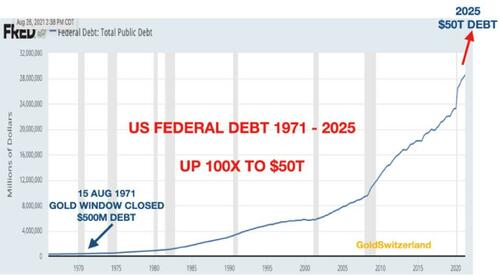

As I have pointed out many times, the US has increased its debt every year since 1930, with a couple of minor exceptions in the 1950s and 1960s. The Clinton surpluses in the late 1990s were fake and in fact deficits.

In history, when there is undue economic pressure, starting wars is popular and often felt necessary. It is convenient to blame the war for the increasing debts.

The Gold Standard was an excellent method for preventing governments to spend money they didn’t have. Since money couldn’t be printed at will, deficits then had to be financed by settling debts in physical gold.

THE GOLD WINDOW HAS BEEN “TEMPORARILY” CLOSED FOR 50 YEARS

As Nixon in the late 1960s had to meet the US debts to France in gold, he decided in 1971 to close the gold window temporarily. He clearly didn’t want to hand all the US gold to de Gaulle. Over 50 years later that gold window is still temporarily closed with fatal consequences for the US and the world.

The chart below shows the exponential growth of US debt since 1971. As we reach the final stages, the debt curve is explosive since 2019.

Creating debts of this magnitude is only possible without the discipline of gold backed currencies.

THE FAT LADY HASN’T SUNG YET

But as I have explained before, the debt explosion is not finished until the fat lady sings. And sadly a lot will happen before she finally sings.

Because like most economic eras, this one will finish with a number of spectacular events, many of which will take place concurrently.

Only a few months ago, Powell and Lagarde were singing from the same hymn sheet about transitory inflation.

But as these Central Bank chiefs prove consistently, they are always wrong. For years they are trying to get inflation to two percent and then, all of a sudden, it is approaching 10% and they don’t understand what has hit them.

They haven’t even understood that Keynesianism was dead before it started.

Even a monkey would understand that if you print $10s of trillions and keep interest rates at zero or negative for years, the end result will be spectacular inflation.

Initially we saw unprecedented asset inflation in stocks, bonds and property but it was always clear that the exponential increase in money supply would eventually reach consumer prices.

THE PERFECT STORM

What is coming next is the inevitable perfect storm.

A perfect storm means that everything that can go wrong will go wrong. And that is not just obvious failures in many parts of society but also totally unforeseen consequences.

Let’s just look at some of the obvious events that will take place in the next few years:

Financial Markets

Stocks have topped worldwide. The correction currently taking place is likely to end very soon in a devastating decline.

Everyone will get slaughtered when hell breaks loose. Whether investors buy the dip or just hold on to their stocks, they won’t understand what has hit them.

Just look at the chart below and the major falls starting in 1973, 1987, 1999, 2007 and 2020. They were all nail biters at the time, but today you can hardly discern many of them on the chart.

For decades every correction has recovered and reached new highs.

But this time WILL BE DIFFERENT, although no one expects it!

Stocks are likely to decline by 75-95% in real terms and not recover for years or maybe decades.

Remember that in 1929, the Dow declined by 90% and that it took 25 years before it recovered in nominal terms. And this time the economic circumstances are exponentially worse.

Bonds have gone up for over 40 years and rates reached zero or negative. Rates have now turned up and we are likely to see interest rates reach at least the 1980 levels of 15-20% and probably higher in a hyperinflationary debt collapse. Many bonds will become worthless and more suitable for framing and hanging on the toilet wall as a reminder for future generations.

Credit markets will come under that same pressure as bond markets with defaulting borrowers, neither in a position to service the debt nor repay it.

Property markets have also reached extremes, fueled by cheap or free money and unlimited credit at very high leverage. In Europe mortgage rates are around 1%. These negligible and irresponsible financing costs have driven property prices to ridiculous and unsustainable levels.

My first mortgage was in the UK. In 1973 the rate went up to 21% in a high inflation environment!

Today, few borrowers could afford an increase to 3%, never mind 10% or 20% like in the 1970s.

As rates rise, it is absolutely certain that the residential and commercial property markets bubble will implode, leading to major defaults, very high vacancy rates and homelessness.

Governments will initially subsidise these markets by endless money printing, but in the end that will fail too as money dies.

Derivatives are a major financial nuclear bomb that is likely to be a death knell for financial markets. As I wrote in a recent article “Chaos and the triumph of survival”, LINK global derivatives, primarily OTC (over the counter), are most likely in the $2+ quadrillion range.

Every single financial instrument contains a derivative element with massive leverage.

Due to the current volatility in commodity markets, most large commodity trading firms as well as hedge funds are now exposed to margin calls.

For example, many JP Morgan clients are currently under enormous stress in a massively over leveraged market.

So if JP Morgan clients are under stress, this means that JPM and other banks will also be under pressure.

Remember that this is just the beginning of the crisis with more bad news unravelling on a daily basis.

As the derivatives market blows up with counterparties failing, central banks will have to print quadrillions of worthless dollars, paving the way for massive hyperinflation.

Banks & Financial System will clearly be under tremendous pressure initially and eventually totally or partly fail as the above problems unravel.

Governments and central banks will obviously be powerless in this scenario. The rescue of the system in 2008 was just a temporary stay of execution. Global debt has trebled since early this century from $100 trillion to $300 trillion. But remember this is mostly fake money which has created false asset values standing on a foundation of quicksand.

All this is now about to collapse.

NOT JUST AN ECONOMIC & FINANCIAL STORM, BUT ALSO HUMAN HELL

The coming economic and financial crisis will have devastating effects on the world. Here are a few affected areas:

Commodity inflation is guaranteed. For years it has been clear that the long-term commodity cycle was bottoming and a massive surge in commodity prices would start. The cycle had already started to go up well before the Ukraine crisis, but it is fascinating how events fall into place in order to create the perfect storm. I covered some of this in my previous article “A Global Monetary & Monetary Inferno of Nuclear Proportions”.

Dollar collapse, together with most other currencies, is guaranteed. As money printing and inflation rises in an uncontrolled fashion, the dollar will quickly reach its intrinsic value of ZERO. Most currencies will follow but they will take turns.

Digital money is likely to be launched in coming years. But I don’t think that crypto currencies will play a major role except as a very speculative investment. More important will be CBDC (Central Bank Digital Currency) which will be another form of fiat money, but now digital. As all fiat money, CBDCs will be quickly debased by endless electronic printing.

WEF & Claus Schwab have got more prominence than they deserve. In my view they will lose whatever power they now have as financial asset values and their wealth implode. Thus, I don’t believe that their reset will happen or succeed. Governments might try resets but they will fail. The only real reset will be disorderly and as outlined above.

Unemployment will increase dramatically as world trade declines and the financial system comes under pressure. Many companies will perish.

Pension systems will fail, as the values of pension funds collapse.

Social security systems will not function as the governments run out of real money.

Human Hell breaking loose will sadly be felt by most people on earth as a consequence of the problems outlined above. And that is without a bigger nuclear war, which obviously would be fatal for the world.

Massive price increases, especially in food and energy combined with shortages, will hit everyone, both developing countries and the industrialised world.

The consequences of food shortages and economic misery, combined with the failure of governments to function properly, will clearly lead to social unrest in many places, even civil war!

THE WAR IS NOT THE CAUSE BUT A VERY GRAVE CATALYST

The current financial and economic crisis was neither caused by Covid, nor by what is happening in Ukraine currently.

The current crisis started with the problems in the banking system and the Repo market in Aug-Sep 2019 and then exacerbated by Covid in early 2020.

The origin of the 2019 banking crisis is obviously the debt bonanza since 1971 and especially since 2006.

Also, the problems in commodity, especially food and energy markets, had already started before the war in Ukraine.

But in a perfect storm, a number of very ugly catalysts will always occur at the worst possible time in order to trigger one worse crisis after the next.

No one knows how this war will end. The Western world is very badly informed about the state of the war since the media is biased pro West and anti Putin. But Putin is not likely to give up easily. Therefore, sadly the war will at best be local and protracted, and at worst lead to consequences which I won’t speculate on at this point.

WEALTH PRESERVATION AND GOLD

For over 20 years I have written about the financial and economic problems that are about to hit the world. Most of the things are happening although I will willingly admit that matters have taken longer than I expected. The financial system was miraculously saved in 2008 which thus was a rehearsal. What will happen next will definitely be for real.

What I have learnt is that we need to be patient since the end of an era and economic cycle doesn’t just happen because you can see all the signs. The process is long and arduous.

Governments and central banks are fighting with all the limited tools they have. But as fiat money has lost 97-99% of its value since 1971, this next time the current monetary system will die like it always has throughout history.

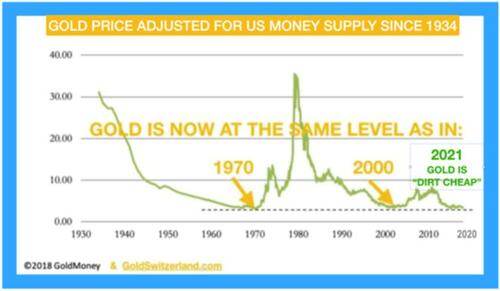

We have invested in and recommended physical gold since early 2002. At the time it was $300. So at $1,920, gold is up 6.4X since then which is better than most asset classes.

But we never bought gold purely for investment purposes, but primarily to preserve wealth. Still, it has been a very good investment for the last 20 years.

As the graph below shows, gold is today is as unloved and undervalued as it was in 1971 at $35 or in 2000 at $290.

Inflation and hyperinflation are likely to destroy most asset values in coming years and currencies will make that final move to ZERO.

The gold price will obviously reflect these moves and will, measured in fiat money, reach levels that no one can imagine. Due to the severity of the current economic and geopolitical situation, gold is likely to do better than just maintain purchasing power.

So preserving wealth in physical gold is today critical. The percentage of financial assets to put into gold is up to everyone to decide for himself. In 2002 I recommended up to 50% and today the risks in the world are exponentially higher.

Finally, what will hit the world in coming years will lead to tremendous suffering as all hell breaks loose, so helping family, friends and others is of extreme importance.

https://www.zerohedge.com/