At the World Economic Forum in Davos

Switzerland, Joseph Stiglitz the Nobel Prize-winning economist argued in favor

of phasing out currency and moving toward a digital economy.

The view expressed by Stiglitz is similar

to that of former IMF chief economist Kenneth Rogoff who has been arguing for

many years that there is an urgent need to remove cash from the economy. It is

held that cash provides support to the shadow economy and permits tax evasion.

Some estimates suggest this could be up to $700 billion in the US.

The Governor of the Bank of England — Mark

Carney — has expressed similar views in support of the removal of cash.

Yet another justification for its removal

is that in times of economic shocks, which push the economy into recession, the

run for cash exacerbates the downturn — i.e., it becomes a factor

contributing to economic instability by facilitating a cash-induced savings

surge rather than an increase in demand.

Other arguments go further, including the

position that in the modern world most transactions can be settled by means of

electronic funds transfer. Money in the modern world is an abstraction, or so

it is held.

But is it true that money is an

abstraction?

The Emergence of Money

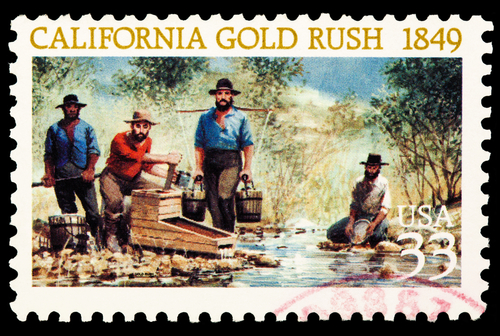

Money emerged because barter could not

support the market economy. A butcher who wanted to exchange his meat for fruit

might not have been able to find a fruit farmer who wanted his meat, while the

fruit farmer who wanted to exchange his fruit for shoes might not have been

able to find a shoemaker who wanted his fruit.

The distinguishing characteristic of money

is that it is the general medium of exchange. It has evolved as being the most

marketable commodity.

On this Mises wrote,

There would be an inevitable tendency for

the less marketable of the series of goods used as media of exchange to be one

by one rejected until at last only a single commodity remained, which was

universally employed as a medium of exchange; in a word, money.1

Similarly, Rothbard wrote that,

Just as in nature there is a great variety

of skills and resources, so there is a variety in the marketability of goods.

Some goods are more widely demanded than others, some are more divisible into

smaller units without loss of value, some more durable over long periods of

time, some more transportable over large distances. All of these advantages

make for greater marketability. It is clear that in every society, the most

marketable goods will be gradually selected as the media for exchange. As they

are more and more selected as media, the demand for them increases because of

this use, and so they become even more marketable. The result is a reinforcing

spiral: more marketability causes wider use as a medium which causes more

marketability, etc. Eventually, one or two commodities are used as general

media — in almost all exchanges — and these are called money.2

Since this general medium of exchange

emerges from among a potentially wide range of commodities, money is, as such,

a commodity.

According to Rothbard,

Money is not an abstract unit of account,

divorceable from a concrete good; it is not a useless token only good for

exchanging; it is not a “claim on society”; it is not a guarantee of a fixed

price level. It is simply a commodity.3

Moreover, according to Mises, “an object

cannot be used as money unless, at the moment when its use as money begins, it

already possesses an objective exchange value based on some other use”4

Why? According to Rothbard:

In contrast to directly used consumers’ or

producers’ goods, money must have pre-existing prices on which to ground a

demand. But the only way this can happen is by beginning with a useful

commodity under barter, and then adding demand for a medium to the previous

demand for direct use (e.g., for ornaments, in the case of gold).5

In short, money is that for which all other

goods and services are traded. This fundamental characteristic of money must be

contrasted with those of other goods. For instance, food supplies the necessary

energy to human beings, while capital goods permit the expansion of

infrastructure that in turn permits the production of a larger quantity of

goods and services.

Through an ongoing selection process over

thousands of years, people settled on gold as money — gold served as the

monetary standard. In today’s monetary system, the core of the money supply is

no longer gold but coins and notes issued by the government and the central

bank. Consequently, coins and notes constitute the standard money, known as

cash, that is employed in transactions. Goods and services are sold for cash.

At any point in time individuals can keep

their money either in their wallets, under their mattresses, in a safe deposit

box or stored — deposited — in banks. In depositing money, a person never

relinquishes ownership. No one else is expected to make use of it. When Joe

stores his money with a bank, he continues to have an unlimited claim against

it and is entitled to take charge of it at any time. Consequently these

deposits, labeled demand deposits, form part of money.

At any point in time part of the stock of

cash is stored, that is, deposited, in banks.

Thus if, in an economy, people hold $10,000

in cash, then the money supply of this economy is $10,000. But if some

individuals have stored $2,000 in demand deposits the total money supply will

remain $10,000: $8,000 cash and $2,000 in demand deposits with banks. Should

all individuals deposit their entire stock of cash in banks then the total

money supply would remain $10,000 — all of it held as demand deposits.

This must be contrasted with a credit

transaction. Credit always involves the creditor’s purchase of a future good in

exchange for a present good. As a result, in a credit transaction, money is

transferred from a lender to a borrower. Such transactions include savings

deposits. These are in fact loans to the bank. With these deposits the

lender of money (the depositor) relinquishes to the bank his claim over the

money for the duration of the loan. These simple credit transactions, however,

— i.e., loans which are not created by the banks as multiples of funds on

deposit — do not alter the amount of money in the economy. If Bob lends

$1,000 to Joe, the money is transferred from Bob’s demand deposit or from Bob’s

wallet to Joe’s possession.

These savings deposits — to be

contrasted with demand deposits — therefore should not be included as

money.

The Digitization of Money

Does the digitization of money change this?

Electronic money is not money as such but a

particular way of using existing money. For instance, by means of electronic

devices Bob can transfer his $1,000 to Joe. He could also transfer the $1,000

by means of a check written against his deposit in Bank A. Joe in turn will now

place the check with his bank, say, Bank B. After the clearance, the money will

be transferred from Bob’s account to Joe’s demand deposit in Bank B.

Note that all these transfers, either

electronically or by means of checks, could take place because the $1,000 in

cash physically exists. Without the existence of the $1,000 nothing could be

transferred.

Now, if Bob pays for his groceries with a

credit card he in fact borrows from the credit card company such as MasterCard.

For instance, if he buys $100 worth of groceries using MasterCard, then

MasterCard pays the grocer $100. Bob, in turn, after one month or earlier

repays his debt to MasterCard in whole or part. Again, all this could not have

happened without the existence of cash. After all, what exactly has been

transferred?

The fact that cash per se was not

used in the above example doesn’t mean that we don’t require it any longer. On

the contrary, the fact that it exists enables various forms of transactions to

take place via sophisticated forms of technology such as electronic or digital

transfers. These various forms of transfer are not money as such but simply a

particular way of moving money. The underlying commodity being used as the

medium of exchange is still cash — just the means of transferring that

cash is different in a digital world.

Importantly, the digitization of the

process of transferring money has been conflated in popular usage with

“digital money.” As the above logic demonstrates, they are two different

things.

The Removal of Money — the Case of India

Any attempt to totally remove cash

— i.e., money — implies the destruction of the medium of exchange

and, ultimately, the market economy. The recent experiment in India to remove

large denomination notes has caused serious havoc. Toward the end of last year

Prime Minister Modi surprised his country by announcing the banning of 500 and

1,000 rupee notes, with some estimating that around 86 percent of all cash in

circulation in India was no longer considered as legal tender.

Any policy directed at phasing out cash in

order to stop the shadow economy has the effect of preventing individuals from

employing their economy’s medium of exchange. This, however, is unlikely to

succeed as individuals will always find various other goods or services to

serve as money.

If legal tender notes were to be banned

then people would simply use something else. The argument that removing cash

will eliminate tax evasion and crime is doubtful. Tax evasion would be reduced

if the incentives for it — high taxes based on big government — were removed.

But what of the claim that the existence of

cash allows “panic withdrawal” during economic crises which therefore

exacerbates those crises?

The fact that during an economic crisis

people run to withdraw their money indicates that they have lost faith in the

banking system — perhaps for good reasons — and would like to have

their money back. The recent Greek “debt crisis” is a textbook example, and

indeed bank depositors were quite correct in their assessment of the state of

their banks.

Here it is necessary to consider the

multiplication of “money” in a modern, fractional reserve banking system. In

the modern world, banks are allowed — indeed encouraged — to

lend multiples of funds on deposit, i.e., create money out of nothing.

When this happens it is indeed likely that a mass withdrawal of cash

deposits can result in a magnified effect on the economy through forced

shrinkage in the credit system and the resulting collapse of the economic

activities that relied on that artificially created money.

What is important to note, however, is that

the problem in this case is not the existence of cash but rather the

artificial creation of additional money by the commercial banks through

fractional reserve lending — mostly with the support of governments. Cash

doesn’t cause crises — central bank-enabled fractional reserve lending does.

Conclusions

Irrespective of the level of technological

advancement of the economy, the essence of money can never change — it is

that against which we exchange goods and services. It is only the (erroneous)

definition of money as an empty abstraction that makes it possible to conclude

that cash can be phased out of the economy with some hypothetical benefits.

This is, in effect, what Stiglitz was suggesting in Davos.

There are other issues associated with the

digitization of money flows which warrant comment.

First, there is the problem that the

mandatory switch from physical money to money held as deposits within banks

will deprive people of the privacy they may wish in the allocation of their

financial resources.

Second, once all cash is transferred to the

banking system, there is the real risk that control over that money is

progressively ceded to that system and to the governments which thrive upon it.

Political or consumption activities that are unpopular with government and/or

commercial interests — especially in an environment of growing powers of

the “security state” — could result in retributive action via restrictions

on access to those monetary balances.

Third, in a purely digital world it would

be impossible to withdraw physical money should people believe that their bank

(or the banking system as a whole) was at risk of collapse. This could

potentially lock people on board a sinking ship, or at least remove the ability

of people to make their own judgments and vote with their monetary feet.

The compulsory switch to purely digital

cash could well become yet another facet of the growing tendency toward the

further centralization of state power and the decline in individual liberty.

Notes:

4.Mises, The Theory of Money and Credit,

p. 131.

5.Rothbard, What Has Government Done to Our

Money?, p. 9.

Note: The views expressed on Mises.org are not necessarily those of

the Mises Institute.

Frank Shostak is an adjunct scholar of the Mises

Institute and a frequent contributor to Mises.org. His consulting firm, Applied

Austrian School Economics, provides in-depth assessments and reports of

financial markets and global economies.