Your

skills, knowledge and social capital will emerge unscathed on the other side of

the re-set wormhole. Your financial assets held in centrally controlled

institutions will not.

Longtime

correspondent C.A. recently asked a question every American household should be

asking: which assets are most likely to survive the "system re-set" that

is now inevitable? It's a question of great import because not all assets are

equal in terms of survivability in crisis, when the rules change

without advance notice.

If you

doubt the inevitability of a system implosion/re-set, please read Is

America In A Bubble (And Can It Ever Return To "Normal")? This

brief essay presents charts that reveal a sobering economic reality: America is

now dependent on multiple asset bubbles never popping--something history

suggests is not possible.

It isn't

just a financial re-set that's inevitable--it's a political and social re-set

as well. For more on why this is so, please consult my short

book Why

Our Status Quo Failed and Is Beyond Reform.

The

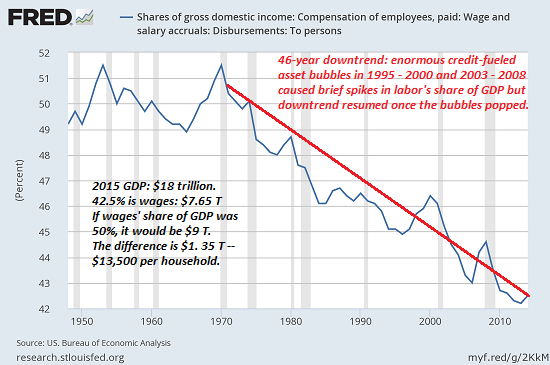

charts below describe the key dynamics driving a system re-set. Earned

income (wages) as a share of GDP has been falling for decades: this means labor

is receiving a diminishing share of economic growth. Since costs and debt

continue rising while incomes are declining or stagnating, this asymmetry

eventually leads to insolvency.

The

"fix" for insolvency has been higher debt and debt-based spending--in

essence, borrowing from future income to fund more consumption today. But each

unit of new debt is generating less economic activity/growth. This is

called diminishing returns: eventually the costs of

servicing the additional debt exceed the increasingly trivial gains.

What

happens when the bubbles pop, despite massive central bank/state interventions? The

entire socio-political/financial system goes through a "system

re-set" in which all the fantasy-based valuations, political denials,

false promises and fraudulent claims collapse in a heap.

In a

crisis, the privileged Elites will change the rules in a desperate attempt to

expropriate the income and wealth of the bottom 99.5% to

preserve their own power.

The

trick is to do so in ways that won't spark an immediate political insurrection.

We can

better understand their policy choices by asking: What's

easy to expropriate, what's difficult to expropriate?

Those

assets that are easy to expropriate will be expropriated first. Those that are

difficult to expropriate are far less likely to be grabbed, due to the high

costs of expropriation and the high risks of sparking a political insurrection.

History

suggests the privileged Elites will pursue two basic strategies to expropriate

the income and wealth of non-elites:

1.

They will expropriate what is easy to expropriate: financial assets in

centralized institutions the state controls: banks, brokerage accounts,

insurance policies, etc.

2.

They will use the time-honored "stealth expropriation" methods:

inflation and taxes.

Any "money"

held in a centrally controlled institution can be expropriated overnight. The

rules will change without warning, so there will be no opportunity to escape

the system.

Direct

expropriation takes many forms. Your funds could be

"bailed-in" (transferred to the bank). Large currency bills could be

declared worthless. IRA and 401K accounts could be transferred into government

bonds, to "protect the account owners from risky investments."

(Naturally, any expropriation will be presented as "for your own

good.")

Or a new

currency could be issued that strips away 90% of the purchasing power of the

old currency. It could be a New Dollar, an SDR global currency, or a

state-issued cryptocurrency. The point is to strip away 90% of the wealth held

in the old currency.

Indirect "stealth"

expropriation has several forms: slow currency

devaluation, also known as inflation, or higher taxes and junk fees (not called

taxes, but you receive no additional value for the higher fees).

The

end result of these policies is you may receive the $2,000 monthly pension you

were promised, but after inflation, currency devaluation and taxes, your real

purchasing power is $100 in today's currency.

So what's

difficult to expropriate? I present some answers in my

books An

Unconventional Guide to Investing in Troubled Times and Get

a Job, Build a Real Career and Defy a Bewildering Economy.

It's

impossible to expropriate one's skills, experience and social capital. These

are intangible forms of capital and so they cannot be confiscated like gold,

currency, land, etc.

Land and

homes are difficult to expropriate for two reasons: private

property is the backbone of capitalism and democracy, and the state

confiscating private property would very likely spark a political insurrection

that would diminish or threaten the power and wealth of the privileged Elites.

Secondly,

it's very costly for the state to maintain the productive output of real

property it has confiscated. Guards must be posted, sabotage repaired, and the

immense difficulties of coercing a rebellious populace to continue working what

they once owned for the benefit of the state and its privileged Elites must be

solved and paid for.

The

state can expropriate farms, orchards and workshops for back taxes (or some

similar extra-legal methodology), but how do you force people to work these

properties productively?

As a

general rule, whatever the super-wealthy own will be protected from

expropriation. Private real property is the foundation of the Elites'

wealth, and while the land of debt-serfs may well be confiscated for back taxes

(the wealthy will buy exemptions from rising taxes), those who own land and

buildings free and clear constitute a political force to be reckoned with.

As I

discuss in my book Resistance,

Revolution, Liberation: A Model for Positive Change, there's one

other asset the state and its ruling Elites cannot expropriate: community.

The state

will also have difficulty confiscating assets that are outside its reach.This

explains the popularity of owning assets in other nations, and the debate over

cryptocurrencies: will states be able to confiscate all cryptocurrencies at

will, or is that technically unfeasible?

The main

takeaway is this: your skills, knowledge and social capital will emerge

unscathed on the other side of the re-set wormhole. Land

and real property you own free and clear (no debt) is likely to remain in your

possession, as long as you can pay soaring taxes/junk fees during the crisis

phase. Your financial assets held in centrally controlled institutions will not

make it through unscathed; they are simply too easy for central authorities to

expropriate.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Check out

both of my new books, Inequality and the Collapse of

Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is

Beyond Reform ($3.95 Kindle, $8.95 print). For more, please

visit the OTM essentials website.