It can't get any worse than this. Jerome Powell is

a Wall Street-coddling Keynesian and Washington lifer who passes

for a Janet Yellen replica---that is, save for his tie and

trousers and his as yet underdeveloped capacity to whine

pedantically.

During his years on the Fed since

May 2012, Powell has voted approximately 44 times to drastically falsify

interest rates and to recklessly and fraudulently monetize trillions

of the public debt. That is, Powell has been all-in for a destructive

central banking regime that is literally asphyxiating capitalist prosperity in

America.

We will get to the latter in more

detail momentarily, but just consider the plight of bank

account savers during the 65 months "Jay" has served

on the Federal Reserve Board. They have been continuously

savaged by negative real interest rates averaging -1.8% per year.

That cumulates to a 9%

confiscation of

inflation-adjusted principal during that five and

one-half year period, but this purported Republican dissented not a

single time.

And now he is being appointed Fed

Chairman by a purported Republican President!

At

this point, therefore, it can be well and truly said that

Wall Street owns the nation's central bank and that the Republican

party has morphed into a gang of dutiful handmaidens. Any semblance

of fidelity to sound money and free market capitalism----of the type, for

instance, so brilliantly articulated by Treasury Secretary Bill Simon during

Ford's time and George Humphreys during the Eisenhower era---has been lost in

the fog of history.

Not only did Republican presidents

appoint the scourges of Greenspan and Bernanke, but the GOP standard

bearers thereafter have essentially embraced more of the same monetary central

planning. During the 2008 campaign, for example, Senator McCain's chief

economic advisory was Mark Zandi of Moody's----a Fed sycophant and

Keynesian "stimulus" devotee if there ever was one. And Mitt Romney's

top economic advisor in 2012 was professor R. Glenn Hubbard of Columbia,

who averred at the time that Bernanke was doing a swell job.

Yes, we know that the Donald came

to the Oval Office with a giant disability on the matter of sound money.

To wit, he claims to be a

billionaire and perhaps is. But if so, it wasn't owing to the genius and

business acumen domiciled in Trump Tower; it was solely and

completely due to the fact that the Donald's 40-year career as a leveraged

real estate developer was flattered beyond measure by the cheap debt and

serial bubbles that have been the essence of central bank policy since Volcker

was fired in 1987.

So we did take his campaign

attack on the Fed's "big, fat, ugly bubble" with several grains of

salt, and knew that his self-characterization as a "low interest

man" did not bode well for his approach to filling the raft of vacancies

at the Fed.

Still, the choice of Powell is a

shocker. This guy is so deep in the tank for the speculative classes and such a

mechanical Keynesian that there is really no hope at all that the era of Bubble

Finance will end-----that is, voluntarily and without a thundering financial

crash.

Indeed, Powell is so mired in Fed

group think with respect to the ridiculous fixation on 2.00%inflation and

the utterly discredited Phillips Curve and DSGE (dynamic stochastic general

equilibrium) models that you might well think he was Charlie McCarthy to

Janet Yellen's Edgar Bergen.

Thus, in almost identical words to

Yellen's blathering at her last presser, Powell has been mystified by an

alleged inflation shortfall and gums at will about too much slack in his

bathtub model of the US economy:

“Inflation is a little bit below

target, and it’s kind of a mystery,” he told CNBC in August. “You would have

expected, given that we’re getting tighter labor markets, that we’d have a

little higher inflation. I think that what that gives us is the ability to be

patient.”

The relationship between slack and

inflation has weakened substantially over the years," Powell said in June

2016. “In addition, inflation depends importantly on the inflation expectations

of workers and firms. A widely shared view among economists today is that,

unlike during the 1970s, expectations are no longer heavily influenced by

fluctuations in inflation, but are fairly constant, or anchored. For both these

reasons, inflation has become less responsive to cyclical changes in the

economy.”

“While inflation expectations seem

to me to remain reasonably well anchored, it is essential that they remain so,”

he said. “The only way to assure that anchoring is to achieve actual inflation

of 2 percent, and I am strongly committed to that objective.”

Folks, that's just the group think

voodoo economics that has metastasized in the Eccles Building for the last

several decades. Indeed, the latter now sits at ground zero in the Swamp,

and the Donald didn't even bother to look beyond its walls to fill a job that

in many ways is more crucial and powerful than his own.

As the Donald would tweet it,

SHAME!

Nevertheless, there can be no

doubt that Powell was the #1, #2, and 3# pick of the Vampire Squid after its

own nominee, Gary Cohn, stepped in some deep dodoo during the

Charlottesville contretemps. The tip-off is Powell's above reiteration of the

2% inflation goal.

The latter has absolutely nothing

to do with genuine economic growth and main street prosperity. It

is merely a ritual incantation used to justify the Fed's plenary intrusion

in the financial markets and relentless manipulation of the most important

prices in all of capitalism: That is, the price of money, debt, the shape of

the yield curve and the valuation of equities and other risk assets.

As we said on Fox Business last

night (video below), after 100 months of s0-called business expansion---the

third longest on record----the idea that the money market rate should still

be 1.13% is

preposterous because in real terms in still negative. It is a massive open

invitation to Wall Street speculators to buy any financial asset with a yield

or prospect of short-term appreciation and fund them with free overnight carry

administered, enforced and guaranteed by the central bank.

Indeed, Powell is so clueless on

this matter that he actually describes the Fed's fundamental policy tool as an

exercise in administering prices in the money and debt markets, thereby

implying that the 12 members of the FOMC know better than the millions of

traders, investors and arbitrageurs who inhabit the casino, and that through

the frail instrument of interest rate pegging can command the performance of a

$19 trillion economy.

Moreover, rather than arguing for

pegging as a one-time, extraordinary response to a putative 500-year flood type

of financial crisis, Powell argues that it constitutes a permanent regime of

control. That is, capitalism is allegedly so fragile, unstable and disaster

prone that it requires permanent guard rails and balancing wheels supplied by

the FOMC in it purported infinite wisdom:

Powell seems to be in agreement

stating in June of this year that "To affect financial conditions, the

Federal Reserve has therefore used administered rates, including the interest

rate paid on excess reserves (IOER) and, more recently, the offering rate of

the overnight reverse repurchase agreement (ON RRP) facility. This approach,

sometimes referred to as a "floor system," is simple to operate and

has provided good control over the federal funds rate. In November 2016, when

the Committee discussed using a floor system as part of its longer-run

framework, I was among those who saw such an approach as "likely to be

relatively simple and efficient to administer, relatively straightforward to

communicate, and effective in enabling interest rate control across a wide

range of circumstances."

The above hogwash is stunning

proof that Greenspan-Bernanke-Yellen-Powell style monetary central

planning is a clear and present danger to capitalist prosperity. It

amounts to a clueless confession of willful incompetence, and evidence that

Powell and the rest of the FOMC----are so mesmerized by

Keynesian academic models that they can't see the real world starring them

in the face.

What's right in front of their collective

noses, of course, is a domestic and global financial system

that is everywhere booby-trapped with massive and incendiary

financial bubbles, unsustainable leverage in both overt and covert forms (i.e.

options), and relentless, liquidity-fueled speculation that infects the

very warp and woof of most financial markets.

Even the core blue-chip

10-year UST market is a speculators' haven where on the margin pricing is

driven by complex, leveraged arbitrages, not the bid of trust

department managers in behalf of widows and orphans.

Indeed, the evidence of an

impending financial blow-up is palpable and plenary.

There is no other way to

describe European junk bond yields at 2% and therefore below the

U.S. Treasury; or the Russell 2000 trading at 95X earnings in

an economic backdrop where most activity measures---from auto sales

ex-hurricane replacement, to housing, restaurant sales, manufacturing

production, business investment, exports, construction spending---are clearly

rolling over.

Likewise, there is the

insanity in the momo precincts of the stock market where the likes of Amazon

and Netflix trade at

280X and 200X net income,

respectively; or where the giant fake auto company, Tesla, trades at an

infinite PE multiple after 10 years of cumulative losses totaling $4.5 billion and which, at a market

cap of $50 billion,

is valued the same as Ford and nearly equal to GM. Between them, the

latter sold 10 million cars last year ----125 times more than Tesla---and

booked $7.5 billion of profits or well more than the latter's

total loss-making sales.

You only need read the

latest Fed minutes---which Powell fully subscribed to---in order to

realize that the Fed's scribe hit the "delete" key when the

discussion turned to financial bubbles. Then again, perhaps the myopic

lenses of their Keynesian beer goggles filtered out entirely the above

evidence of today's raging mania in risk asset markets, thereby

ensuring that our monetary central planners will be taken by

"surprise" for the third time this century.

The screaming disconnect implicit

in Fed policy is evident when you compare Powell's

group-think complacency with the FOMC's fastidious

pre-occupation with its preferred short-term inflation measures. That is,

both the CPI and the PCE deflator have been in the 1.4% to 2.2% corridor for several months now,

but the FOMC remains pre-occupied with "low readings".

Yet there is not a shred of

evidence that 50 basis points of difference in a generic market

basket of prices (which no one actually buys) makes any difference whatsoever

to economic function in the main street economy. Well, except

for pensioners, savers and most workers, whose purchasing power will fall

further behind the closer the Fed gets to its magic 2.00% inflation

reading.

We choose to express the Fed's

inflation goal to the second decimal point to highlight the lunacy of the

entire inflation targeting regime. In fact, there is a breath-taking

mismatch between the Fed's inability to see a $200-300 billion

bubble of bottled air at Amazon, which enables it to ignore profits and

investment returns in order to pursue a scorched earth policy of predation and

destruction across the American retail landscape, and the fact that Fed heads

like Powell spend countless hours down on their hands and

knees with magnifying glass parsing utterly trivial differences in the PCE

deflator readings.

Some members stressed the

importance of underscoring the Committee's commitment to its

(2%) inflation objective. These members emphasized that, in considering

the timing of further adjustments in the federal funds rate, they would be

evaluating incoming information to assess the likelihood that recent low

readings on inflation were transitory and that inflation was again on a

trajectory consistent with achieving the Committee's 2 percent objective over

the medium term.

In short, this is a case of

missing the forest for the trees like no other, and exposes the screaming

contradiction at the heart of our rotten regime of monetary central

planning.

Today's Keynesian central

bankers-----and Powell is surely one straight from central casting--- are

always aiming to enhance, uplift and stimulate the main street economy but to

do so they must detour through the canyons of Wall Street because that's

where their instruments of control reside.

As we indicated above, the

Fed seeks to transmit its

stimulus policies through the money markets by pegging overnight

funding rates including Fed funds and through the fixed income

and other securities markets, where its open markets desk drives the

level and shape of the fixed income yield curve through bond purchases with

fiat credits.

In this context, it is important

to note that Janet Yellen, Jerome Powell and their ilk are

playing a totally different game than their Keynesian grandfathers such

as professors James Tobin, Walter Heller and Paul Samuelson. The

latter were primarily fiscalists, which

meant that if they wanted more housing production, for example, they

would turn to builder subsidies or tax credits.

Likewise, if they felt the main

street economy would have more zip with higher consumer spending,

they would peddle tax rebates or increased entitlement benefits. And

the same approach prevailed if more business investment was deemed to be

helpful---as in Walter Heller's (Kennedy's chief economist) invention of

the investment tax credit in 1962.

In a word, these grandfatherly

Keynesians could do considerable long-run damage to capitalist prosperity and

growth by causing resources to be channeled to sectors of the economy and

purposes that deviated from market outcomes, and would thereby inevitably

result in inefficiency, malinvestments and waste.

But the saving grace was

transparency, targetability and limited collateral effects. Back in the 1970s,

for example, the homebuilders and S&L industry were always looking to help

the national economic good by offering first time buyer credits for new

homes or rent subsidies to induce apartment construction. But you could measure

the budget expense, debate the social cost/benefit equation and be reasonably

sure that the subventions involved did not go into speculative schemes on Wall

Street.

Yet here

is exactly where Alan Greenspan and his successors and assigns---of whom Powell

is the latest---- committed the economic sin of the century.

Greenspan was actually an anti-Keynesian in the old fashioned fiscalist sense

and was a frequent comrade-in-arms with your editor in the budget battles of

the early 1980s. Indeed, he helped us defeat every single Keynesian fiscal stimulus scheme that was floated

on the Washington Swamp waters during the 1982-83 recession.

But

apparently no good deed goes unpunished---especially when like Alan

Greenspan you are always being too clever by half. That is, when he got to the

Fed and soon had his hands all over the control dials on its printing presses,

he had the epiphany that fiscal Keynesianism could be defeated permanently

by seconding the job to the Fed.

Thus, if you wanted more housing

starts, twist the interest rate dial to cheaper mortgages; or if you want more

business investment, ginger the corporate stock and bond markets; or if you

want more consumer spending, drive mortgage rates lower and housing prices

higher so that households could supplement their earned incomes with MEW

(mortgage equity withdrawal).

But as we said, this was way too

clever by half. That's because Greenspan's backdoor

Keynesianism unleashed the PhDs, bankers and policy apparatchiks that get

appointed to the Fed to descend into the canyons of Wall Street en masse

and continuously. So doing, it gave them license to fiddle and falsify all the

financial asset prices that percolated through what had otherwise been the

price discovery process of the free market.

From our vantage point 30-years

later it is evident that this was a colossal mistake---the equivalent of inviting

the Huns into Rome. And now, Jerome Powell is apparently the latest monetary

Attila.

The fact is, the financial markets

are the very heart of capitalism and constitute the delicate mainspring

from which all else flows. Money, debt and other forms of capital most be

priced efficiently, accurately and by the unfettered operation

of the auction process for balancing supply and demand. That's the

only way you get allocative efficiency, financial discipline and rewards for

true economic innovation, invention and entrepreneurial creativity all at the

same time.

Accordingly,

policy-making agents of the state should never, ever be allowed into the free

market of finance. In fact, a policy regime that is

explicitly posited on altering and falsifying financial asset prices

is the mortal enemy of vibrant capitalism and true gains in living standards

and wealth.

As we approach the third bubble

crash of this century, the reason should be finally evident.

Namely, financial repression massively incentivizes speculation,

leveraged arbitrage, rent-seeking churning in the secondary markets and the

diversion of real capital from the corporate sector and main street economy

into financial engineering schemes which fuel even more speculation on Wall

Street.

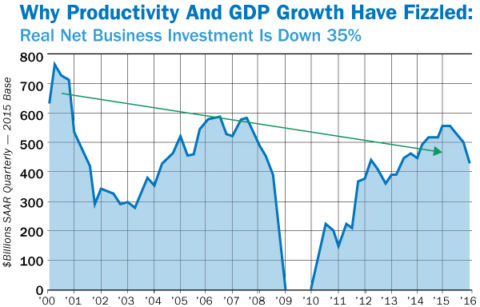

Thus, notwithstanding a tripling

of business debt outstanding since the turn of the century, real net investment

in productive business investment is 35% lower than it was in the year 2000.

Instead, the price falsification

policies of the Fed have turned Wall Street into a gambling casino and the

C-suites of Corporate America into financial engineering outfits. Accordingly,

upwards of $15

trillion has

been cycled back into Wall Street during the last decade in the form of

stock buybacks, unearned dividends, M&A deals and LBOs and recaps that

fueled stock market inflation, not real investment, growth and jobs.

There is a saying that if your

only tool is a hammer everything looks like a nail. So with still another

clueless Keynesian taking the helm at the Fed---and in complete

denial about the monumental bubbles and financial stability risks all

around---- it can also be well and truly said that if your only

policy tool is to falsify financial assets prices you will repeatedly end up

inflating bubbles until they eventually crash---and never see them coming, to

boot.

So if the state must give

capitalism the "help" it doesn't need----then at least bring back our

Keynesian grandfathers to the fiscal arena. With $31 trillion of public debt already

built in through 2027, they will get nowhere as the GOP tax-cutters are about

to prove.

At least the fiscalists did

not practice "trickle-up" economics by inflating bubbles

that pleasure the 1%, but do nothing for the main street economy.

That's the real irony. Modern

central banking has not brought they ballyhooed Great Moderation, but a

perverse cycle of periodic bubble collapses, which, in turn,

induce corporate C-suites to attempt to protect their stock prices and

options by throwing workers, assets and business infrastructure overboard

in a desperate effort to appease the trading machines and gamblers on

Wall Street.

So forget the Fed's inflation

targeting and its bathtub economics gibberish. Yellen, Powell

and the rest of the Eccles Building posse are hopelessly Bubble Blind

because inflating bubbles is the essence of what they do.

Then

again, it is likely that Powell will be the last of the bubble blowers. Like

Yellen he is so blind to the incendiary devices implanted throughout the

financial system that he will likely continue her campaign to reload the Fed's

dry powder in order to combat the next recession somewhere down the road.

To that end, Powell has indicated

he will pursue monetary policy normalization and balance sheet shrinkage until

the Fed's footings are rolled back to the $2.5 trillion neighborhood.

That means a year from now the Fed

will be selling bonds at a $600

billion annual

rate per its announced schedule and that will come atop a new borrowing

requirement at the Treasury in the $1

trillion + annualized range. And since the law of supply

and demand has not been repealed----that bond selling tsunami will surely

cause a traumatic rise of bond yields across the entire spectrum.

In a word,

"Janet Yellen Powell" has drawn the short straw. On his watch, the

whole misbegotten enterprise of 30 years will blow sky high.

To that extent, the Great

Disrupter once again today lived up to his historic mandate. But not in what

the boys and girls and robo-machines on Wall Street would perceive as a

"good way".

To the contrary, they will

learn the hard way about the end of Bubble Finance in the very near

future.

http://davidstockmanscontracorner.com/janet-yellen-powell-puts-on-some-pants-and-a-tie/