Our long-time readers are

familiar with the work of Professor Baruch Lev of the NYU Stern School of

Business, whose research forms the basis for the Knowledge Leaders investment

strategy. In his decades-long study of financial records, Lev first discovered a link

between a firm’s knowledge capital and its subsequent stock performance,

ultimately identifying a market inefficiency that leads highly innovative

companies to deliver excess returns. We call

this market anomaly the Knowledge Effect.

In a new article in Financial Analysts Journal, Lev

and co-author Feng Gu continue to advance the findings on intangibles. The

article, “Time to Change Your Investment

Model,” identifies that earnings

prediction has lost “much of its relevance in recent years.”

As a form of predicting

corporate results, “earnings no longer reliably reflect changes in corporate

value and are thus an inadequate driver of investment analysis.”

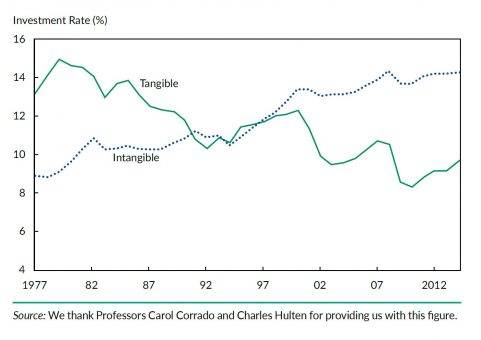

The basis for this shift, the authors explain, occurred after the

emergence of the semiconductor.

“Starting in the early 1980s, investment in

traditional, tangible assets (structures, factories, machinery, inventory) –

considered assets by accountants and reported accordingly on the balance sheet

– dropped precipitously from 15% of gross added value in 1977 to 9% in 2014, a

40% drop.

In contrast, the investment rate in

intangible capital (R&D, patents, information systems, brands, media

content, business processes) – mostly expensed in corporate income statements –

increased continuously from 9% to 14% of added value, a 56% increase. This

radical business model transformation came to be known as the knowledge – or

information revolution, an irreversible trend in developed economies.”

As a result, for companies,

“the only way to survive and prosper in such a competitive environment (is)

through constant product and process innovation, achieved primarily by

investing in intangible assets.” Therefore, “earnings’

usefulness to investors declines sharply for companies that increasingly rely

on intangible value-creating assets.”

For these reasons, “GAAP-based reported earnings no longer reflect

the periodic value changes (growth) of most business enterprises, and thus

conventional earnings-based security analysis has lost much of its usefulness

for investors in recent years.”

In summary, the authors observe:

“The disappointing returns on

managed funds in recent years should raise doubts about the continued

usefulness of conventional security analysis. Our extensive empirical evidence

on the loss of relevance of GAAP numbers, in both this article and our recent

book, confirms these doubts. Certain major investors have already departed from

the status quo. … We propose a different course: Rather than replace analysts

with robots, substitute an improved investment methodology for an outdated

one.”

If you’re interested in reading

Lev and Gu’s article, download it here. Stay tuned for more on Professor Lev’s

research in early 2018 and an in-depth Q&A on his latest research on

intangible capital.