While we are being distracted by Ukraine, President Putin has advanced his geopolitical goals materially. Aided and abetted by President Xi, Putin is taking the Asian continent into his control. That mission is well on its way to being achieved. He now awaits the winter months to finally force the EU to reject America’s hegemony. Only then, will the western end of the Eurasian continent be truly free of American interference.

This article explains how he is achieving his strategic goals. It examines the geopolitics of the Asian landmass and the nations tied to it, which are commercially and financially turning their backs on the US-led western alliance.

I look at geopolitics from President Putin of Russia’s viewpoint, since he is the only national leader who seems to have a clear grasp of his long-term objectives. His active strategy conforms closely with Halford Mackinder’s predictive analysis of nearly 120 years ago. Mackinder is regarded by many experts as the founder of geopolitics.

Putin is determined to remove the American threat to his Western borders by squeezing the EU to that end. But he is also building political relationships based on control of global fossil-fuel supplies — a pathway opened for him by American and European obsessions over climate change. In partnership with China, the consolidation of his power over the Eurasian landmass has progressed rapidly in recent weeks.

For the Western Alliance, financially and economically his timing is particularly awkward, coinciding with the end of a 40-year period of declining interest rates, rising consumer price inflation, and a deepening recession driven by contracting bank credit.

It is the continuation of a financial war by other means, and it looks like Putin has an unbeatable hand. He is on course to push our fragile fiat currency based financial system over the edge.

Mackinder’s legacy

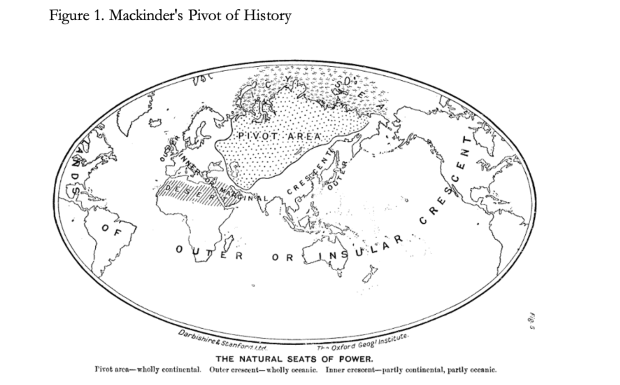

In a paper presented to the Royal Geographic Society in 1904, the father of geopolitics, Halford Mackinder, effectively predicted what is happening today. In his presentation, he asked:

“Is not the pivot region of the world’s politics that vast area of Euro-Asia which is inaccessible to ships, but in antiquity lay open to the horse-riding nomads, and today is about to be covered with a network of railways?

“Outside the pivot area, in a great inner crescent, are Germany, Austria, Turkey, India, and China. And in an outer crescent, Britain, South Africa, Australia, the United States, Canada, and Japan.”

This is shown in Figure 1, taken from the original paper presented to the Society.

In 1919 after the First World War, in his Democratic Ideals and Reality he summarised his theory in slightly different language thus:

“Who rules East Europe commands the Heartland;

Who rules the Heartland commands the World-Island;

Who rules the World-Island commands the world.”

This is Putin’s destiny. In conjunction with China (rather than a united Germany, which is what worried politicians such as Balfour before the First World War), Russia appears to be successfully pursuing her goal of control of Mackinder’s World Island. Today, we can expand on the inner crescent concept to include Iran, the Middle East, as well as the new nations spun out of the old Soviet Union. Of Mackinder’s original inner crescent, only Germany and Austria are omitted today. Austria was the centre of the Hapsburg Empire at that time and so is no longer geopolitically important.

Of the outer circle, we can now include most of Africa and some of South America, which are increasingly dependent on the World-Island for demand for their commodities. Without the West’s media and public seeming to realise it, there has been and continues to be an extension of Russian power through Asian partnerships which now eclipses America’s in terms of the global population covered. And if we add in China’s diaspora in South-East Asia, America and her NATO allies look like a somewhat isolated minority.

As well as political power ebbing away from the West, economic power is as well. Hampered by increasingly expensive and anti-capitalist democratic socialism, their economies are struggling under the burden of their governments. And as the West declines, the World-Island is enjoying its own industrial revolution. The network of railways, to which Mackinder referred in 1904, has expanded from the trans-Siberian railway to China’s new overland silk roads, linking China with Western Europe and the great nations south of the original silk road.

Russia and its ex-Soviet satellites occupy half the Eurasian continent. The Eurasian continent is 21 million square miles, or more than three times the size of all North America. Central and North America together measure some 9 million square miles, more than twice the area of Europe. Even without its ex-Soviet satellites, Russia is still by far the largest nation by land area. And together with China, Russia is nearly three times the size of the United States.

Russia is the world’s largest single source of energy, commodities, and raw materials and as we now see can control the prices the West pays for them. As a consequence of recent sanctions, the west is paying top-rouble, while Russia’s Asian allies have energy and commodities offered at a discount payable in their own currencies, undermining the West’s relative economic position even more.

As to whether Putin has studied Mackinder, this must be supposition. But there is no doubt that if he is not so guided, Putin is following the same predicted course. As Russia’s undisputed leader, he has played the geopolitical game masterfully. He does not fall into the traps which bedevil Western socialism. He follows foreign guidelines in the mould of the British at the time of Lord Liverpool’s Prime Ministership two hundred years ago, when the policy was not to interfere in the domestic affairs of foreign nations, except to the extent that they affected British interests.

It is a fact of life for Putin that his allies include some very unpleasant regimes. But this does not concern him — their domestic affairs are not his business. His business is Russia’s interests, and like the British in the 1820s, he pursues them single-mindedly.

The rationale behind Ukraine

Ukraine was an unusual instance of Putin taking the initiative in acting against the American-led NATO alliance. But in the run-up to Ukraine, he had seen Britain leave the EU. Britain was America’s vicar on the EU’s earth, so Brexit represented a significant decline in the US’s ability to influence Brussels. Following Brexit, President Biden precipitously exited Afghanistan, taking the rest of NATO with him. Therefore, America was on the run from the Heartland. The way was open for Putin to push further and expel America from Russia’s western borders.

To do this, he needed to confront NATO. And there is little doubt this was on Putin’s mind when he escalated his “special military operation” against Ukraine. He must have anticipated NATO’s reaction to impose sanctions, from which Russia has profited greatly. At the same time, it is the EU which has been badly crushed, a squeeze which he can intensify at will.

The drama is still playing out. He needs to keep up some pressure on Ukraine to keep the squeeze going. He is not ready to compromise. Winter in the EU will be tougher still, with energy and food shortages likely to lead to increasing riots by the EU’s citizens. Putin will only stop when the Europeans realise that America is sacrificing them in the pursuit of its hegemony. Zelensky is little more than a puppet in this drama.

With respect to the war on the ground, Russia has already secured its access from the Black Sea by cultivating her relationship with Turkey. As a NATO member, Turkey is hedging its bets. The Black Sea is vital to her economic interests. For this reason, Turkey is maintaining her relationship with Russia, while cooling down her antipathy to Israel (President Herzog visited Ankara in March) and mending her fences with the UAE — it’s all part of the World Island coming together.

For the US, Erdogan is an unreliable NATO partner. Allegedly, the US tried to remove him by instigating a failed coup attempt in 2016, when he was tipped off by Russian intelligence and the coup failed. While he owes a favour to Putin, Turkey’s NATO membership leads him to be cautious. And as a born-again Sunni, he appears keen to extend Turkish influence into the Moslem nations in Central Asia, dreaming perhaps of the glory days of the Ottoman Empire.

To further Russia’s power over energy sources upon which the Western belligerents depend, Putin has cultivated Iran, and has also made welcoming overtures to Saudi Arabia and the UAE. Sergei Lavrov, Putin’s foreign minister, took care to fully brief members of the Arab league of Russia’s energy policy in Cairo last month. The argument is simple: the West has turned its back on fossil fuels, planning to phase them out entirely in a decade or so. As producers of oil and gas, their future is to stick together with Mackinder’s World Island and its Inner Crescent. This is so obviously the case, that even Saudi Arabia is said to be seeking an association through the BRICS group.

Whatever the merits of climate change driven policies, with respect to energy the West seems to be hell-bent on a suicide mission. But Russia’s message to its partners is that you can have oil and natural gas at a discount to what Europe has to pay. Putin is offering to release them fully from the West’s climate change ideology.

With the pressure he is applying on Western Europe, Putin almost certainly assumes European politicians will be driven from supporting US sanctions to a more neutral position. And Russia probably expects that non-aligned nations suffering from grain shortages will also pressure the West to bring sanctions to an end. But before Putin relinquishes the pressure on EU nations, he is still likely to insist that American influence from Western Europe is withdrawn, or at the least it is withdrawn from Russia’s western borders.

Phase 1 has concluded. Let Phase 2 begin

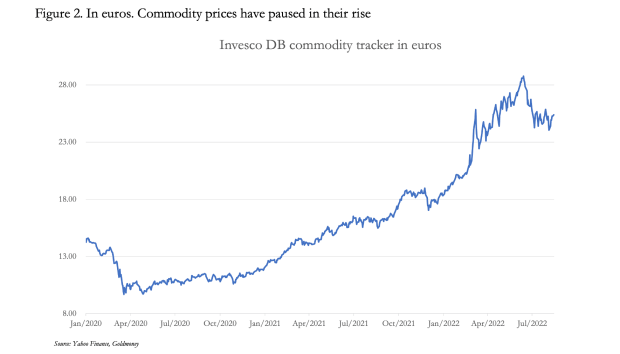

We must now turn from Putin’s supposed megalomania to the conditions faced by his Western enemies, particularly the nations in Europe and the Eurozone. Figure 2, which is of a basket of commodities and raw materials priced in euros, shows that after a significant rise, for Europe prices have eased in recent months.

For the beleaguered Europeans, the pause in a substantial rise in commodity prices since the Fed’s introduction of zero interest rates in March 2020 has given them temporary and minor relief from an escalating inflation headache. Perhaps it is premature, but investors in western markets are taking the pullback in commodity prices as evidence that the commodity squeeze is probably over, and that with it the problem of consumer price inflation will diminish as well.

Indeed, in his 1 August report for Credit Suisse, Zoltan Pozsar reported that he had visited 150 investment managers in eight European cities recently, and the consensus was just that: they think inflation is licked, recession is due, and therefore interest rates will shortly decline.

But so long as he holds the pricing reins for energy, Putin can play with the euro to his heart’s desire. By manipulating his quasi-monopoly on energy, grains, and fertilisers he can increase pressure on the EU’s leaders to reject US hegemony. And to fully appreciate the power in Putin’s hands, it is important to understand the true relationship between fiat currencies and commodities.

The evidence is that the volatility of commodity prices is in the fiat currency they are priced in, and not the commodities themselves. Figure 3 shows this relationship, by comparing the price of oil measured in legal money (gold) and the fiat euro currency.

The most the price of oil in gold has varied on the upside is double at the time of the Lehman failure, whereas in euros at that time it was sixteen times. So far this year, it has been even more volatile when the price in gold fell to 70% of the 1950 price, while in euros it hit 15 — that’s 21 times as volatile.

This finding turns all energy pricing assumptions upside-down. The chart shows that what was true before the ending of Bretton Woods was no longer true after 1971. [The euro only commencing in 2000, the currency taken before then was the German mark]. Since oil prices are wholly determined in markets whose participants all assume price volatility is in the commodity, the entire basis of price forecasting becomes undermined. That being so, if an analyst gets a forecast half right it is more by luck than judgement.

This is the whole point behind sound money. With sound money, dealers in commodities and all other goods justifiably assume that the intermediating medium is a constant. They assume that when they receive payment, its utility is invariable. But with unbacked fiat it is different. For individual transactions, while we still assume a dollar is a dollar and a euro is a euro we all know that a currency’s utility varies. Why, then, for analytical purposes do forecasters always assume it does not? Why do analysts never take this into account in their forecasts?

Figure 3 above proves that conventional approaches to pricing and economic forecasts involving them are nonsensical. The same is demonstrably true for all other commodities, not just oil. In current circumstances, the basis for an incorrect analysis is being used to support expectations that prices are beginning to reflect an increasing prospect of recession, which to a Keynesian or monetarist mind, means falling demand for commodities and energy leads to lower prices. But the fact remains that overnight, Putin can put the squeeze on the EU again. And armed with the knowledge that price volatility is in the currency, we know that the falling euro will do most of his work for him.

As we approach Europe’s winter, it will not take much to drive energy prices in euros considerably higher. Putin is unlikely to make the mistake of being seen to do this deliberately. But in all probability, he need not take any significant action at all to see Western currency prices for energy and food rise again as winter approaches.

There is a further misjudgement common to Western capital markets: this time over interest rates. In almost every piece of analysis forecasting recession, the underlying assumption is that with economies turning down demand for goods, services and credit will diminish. For these reasons, interest rate pressures are expected to decline.

This misunderstands the nature of credit. Almost all circulating media is commercial bank credit. Consequently, GDP is simply the sum of all bank credit used for qualifying transactions. Therefore, nominal GDP is set by the availability of bank credit, and not, as commonly supposed driven by a slowdown in economic activity. When the banking cohort contracts its collective balance sheet, interest rates initially rise because of a shortage of credit.

These conditions are now faced by financial markets. Commercial banks are bound to seek ways to protect themselves in uncertain times. They are already looking to reduce the ratio of their assets to equity before bad debts really escalate. Banks in the Eurozone are not alone with this change in outlook. The so-called global recession is not being driven much by other economic factors, but mainly by the tendency for bank credit to be withdrawn from both financial and non-financial economic sectors.

It is a problem poorly understood and never mentioned by analysts in their economic forecasts. But in the current economic and financial environment, the consequences lead to a conclusion about interest rates the opposite of that commonly supposed.

We can see from the foregoing that contrary to expectations expressed everywhere by western governments and their central banks along with the whole investment establishment, the inflation and interest rate problem is not going away. Because interest rates had been suppressed and could go no lower and for no longer, there has been a fundamental shift from a long-term decline in them, to what is increasingly sure to turn out to be a long-term trend for interest rates to rise. As it is elsewhere, the bank lending environment in Europe is deteriorating for obvious reasons. Furthermore, it comes at a time when bank balance sheet leverage is at record levels, leaving banks badly exposed to the change.

A severe contraction in bank credit is only in its initial stages. A second phase in the economic and financial war against Putin’s Russia will shortly emerge. Currently, we appear to be in a summer pause after the first, indicated by consolidating commodity prices. Government bond yields have declined from earlier highs. Stock markets have rallied. Bitcoin has rallied. Gold, which is the only legal money from which to escape from all this, has declined. It all indicates a false optimism, vulnerable to the rudest of shocks.

China may be Putin’s only wildccard

With its economy based on commodities whose values are aligned with gold and so long as the current geopolitical situation does not escalate into a wider military conflict, Russia appears to be in a strengthening economic position while her adversaries are in decline. If there is a threat to its position, it probably comes from her alliance with China, which is exposed to the West’s follies through trade. China has some wildcard problems.

Since the death of Mao, in its rapid development China has relied on the expansion of credit through state owned banks. Bank executives are state functionaries, instead of managers on behalf of profit-seeking shareholders. It is this difference which has insulated the domestic economy from the cycles of bank credit which have plagued the West’s economic model with repetitive credit crises.

While this lack of destructive cyclicality might be seen as a good thing, it has allowed malinvestments to build up uninterruptedly over recent decades. So, while the Chinese authorities still exercise significant control over lending, the degree of economic distortion has become a threat to further progress.

This is being manifest in a growing property crisis, with developers going to the wall in droves. It’s not that there is unlikely to be demand for commercial and residential properties in the future: the savers are there to buy, the middle classes are growing in number, and the economy has some way to go in its development. The problem is that the property market has got ahead of itself.

As a sector, property and related activities make up an estimated one-third of China’s economic activity. Developers have suspended completions of pre-sold properties, which citizens have bought on a pre-payment basis. Consequently, mortgage payments are being suspended by angry purchasers. Private banks have been affected, with bank runs against some of them. Some thirty real estate companies have missed foreign debt payments, with Evergrande being the most high-profile defaulter on $300bn of debt.

Problems in property were and are still being compounded by Beijing’s zero tolerance covid policy. More so than in other jurisdictions, strictly enforced clampdowns have hit production and undermined logistics, factors that have inevitably undermined economic performance. While exports to other nations have held up well — mostly due to foreign governments’ spending deficits escalating and not being matched by increased personal savings — China’s exporters’ profits are bound to become squeezed by the West’s deepening recession. Unless, that is, China’s foreign exchange policy is to deliberately weaken the yuan against western currencies. But that will only end up destabilising the domestic economy as consumer price increases accelerate.

And lastly, if Beijing follows up on its threats to annex Taiwan — if only to detract from domestic economic failures — a train of events is likely to be set in motion which could escalate tensions with America and its defence allies to the detriment of everyone.

But despite the headlines from China’s property crisis, it is too early to assume China is descending into much deeper trouble. It must abandon macroeconomic policies driven purely by statistics and ensure its citizens and their business have a stable currency. Whether this is understood in Beijing is not clear.

The fundamental difference from its Russian partner is its greater economic dependence on consumption of commodities as opposed to their production. The consequences of western economic policies set to undermine their own currencies’ purchasing power will be felt more by China than Russia. Nevertheless, an increasingly likely banking and currency crisis in the West can be weathered by China with the correct economic approach.

The era of the dollar is ending

While Putin appears to be gaining control of the World Island, leaving a few nations on its fringes adhering to the US and its currency’s hegemony, much of what he has achieved is through the abject failure of the West in playing this greatest of great geopolitical games. A notable feature of the West’s decline is in its embrace of anti-capitalistic and woke cultures. In this article, it would lose our focus if we drifted into the climate change debate, other than to point out that by seeking to eliminate fossil fuels in the next decade or so, the West is on a course of economic self-destruction relative to Russia’s partners, who are being offered discounted oil, gas, and coal for the foreseeable future.

When President Nixon turned the dollar into an entirely fiat currency in August 1971, he set off a train of events which is now ending. From establishing the dollar as the world’s reserve currency, and his agreement with Saudi Arabia which led to the creation of the petrodollar, global fiat currency instability commenced as shown in Figure 3 to this article. But the fiat dollar gave both the US Government and the American banking system enormous power. That was effectively wielded, forcing recalcitrant nations to kowtow to the mighty dollar.

The power was not used judiciously, leading to an alliance between Russia and China to protect themselves from US actions. The lessons they learned from American imperialism were not lost. Despite earlier promises to Russia not to do so, the US military directly threatened her western border. For China, though her economic and industrial revolution having been initially praised, she began to be seen as a threat to the American interests.

This imperialism has made America few friends and many latent enemies. With repeated failures in US foreign policy in the Middle East, North Africa, Ukraine, and most recently Afghanistan, the US can now count on nations representing only about 19% of the world’s population of 8 billion people, compared with 54% allied to the World Island. This is shown in Figure 4.[i]

While allocating nations into these categories is somewhat subjective, it gives an approximation of the relative power of the World Island partnership compared with that of US/NATO. As the US-led partnership’s grip slackens, vested interests are sure to drive non-aligned nations towards the World Island camp, particularly when they have commodities to sell.

Before Russia’s invasion of Ukraine and the sanctions that followed, none of the 170 nations in the table could do without the dollar. Russia has been forced to find alternative settlement currencies and its close allies in the Eurasian Economic Union are planning a new trade settlement currency to cut out the dollar. But the international pricing of commodities and raw materials in dollars is impossible to overcome, even for Russia.

The World Island cannot side-line the dollar completely — it is too entrenched. While the dollar’s power is declining, the destruction of its virtual monopoly in international trade will have to come from US monetary policy itself, a process that is arguably under way.

Since the financialisation of Western economies in the mid-eighties, the dollar has retained its credibility as the world’s reserve currency. It was achieved by ensuring a ready supply for international use, as forecast by Robert Triffin by his description of the dollar’s dilemma in the late fifties. The demand side was bolstered by the development of regulated and unregulated derivative markets, which forced foreigners to purchase dollars in order to purchase derivatives. Essentially, it was synthetic dollar demand created to satisfy speculator demand for commodities, including precious metals, by creating synthetic supply.

When this concept is grasped, the importance of the ending of the long-term trend of interest rate suppression becomes better understood. The suppression of commodity prices by increasing synthetic supply became part and parcel of interest rate declines. Interest rates are no longer declining but rising. There will be unexpected consequences for commodity prices, which we will come to in a moment.

There are two immediate consequences for bank lending: their lending margins improve, and the incidents of bad and doubtful debts increases. Consequently, overleveraged bank balance sheets are being cut back by banks no longer having to work them so hard to maintain bottom-line profits. And with lending risk escalating, this is a further reason to contract bank credit overall. Credit is going to be in increasingly short supply.

There are the consequences for financial markets, including synthetic commodity supply, to be considered as well. Under the new Basel 3 regulations which were recently introduced, trading and market-making in derivatives is an inefficient use of balance sheet capacity, so these activities are bound to be reduced over time under pressure from banks’ treasury departments. In effect, the conditions that allowed banks to expand credit to finance the increase of derivative trading activities between 1985 and 2021 are being reversed.

According to the Bank for International Settlements, the notional value of global regulated futures totalled $40. 7 trillion last March, and in options totalled a further $54 trillion.[ii] To this must be added over $610 trillion in over-the-counter derivatives.[iii] For now, it is variations in this synthetic supply which drive pricing relationships between fiat currencies and commodities. But the impact of contracting bank credit will almost certainly lead to higher commodity prices, as this synthetic supply dries up and is increasingly withdrawn.

Furthermore, contracting bank credit invariably leads to banking failures. And with the Eurozone’s and Japanese global systemically important banks leveraged over 20 times on average, the scale of banking failures is likely to be significantly larger than that of Lehman when it failed fourteen years ago next month.

And finally, as insurance against a widespread fiat currency catastrophe, both Russia and China have stockpiled physical bullion. Russia is known to have about 12,000 tonnes, of which 2,300 tonnes are held as monetary reserves. It mines 330 tonnes annually, which it is now adding to its hoard. Having accumulated the bulk of its hoard before permitting the Chinese public to buy gold, China’s state probably has over 30,000 tonnes, of which only 1,776 tonnes are declared official reserves. Since its inception in 2002, China’s citizens have taken delivery of a further 20,000 tonnes from the Shanghai Gold Exchange, some of which will have returned as scrap.

Therefore, the Russian and Chinese states between them command over 40,000 tonnes, which compares with America’s reserves, officially listed as 8,133 tonnes. As nations, they are also the two largest gold miners by output.

There can be no doubt that both China and Russia have a better understanding than western central banks of the relationship between money, which legally and in actuality is gold, and credit. They can only have built their reserves and mining capacity in anticipation that their currencies will need, one day, protection from a fiat currency crisis. First it was China, which accumulated most of her stash during the 1980-2002 bear market at prices as low as $275, before letting her citizens buy gold. With Russia, the accumulation has been more recent, undoubtedly seen by Putin as an essential part of his geopolitical ambitions. Both countries have concealed their true gold position, presumably so as to not threaten the dollar’s hegemony directly and to allow them to secretly add to their hoards.

In the event of a fiat currency crisis for the dollar, both the rouble and yuan have more monetary projection backing them than in any of the currencies of their adversaries. And while the jury might be out with respect to President Xi’s geopolitical nous, there can be little doubt that Putin will do whatever it takes to protect Russia, the rouble, and his geostrategic plans from any crisis which might envelop the West.

[i] See https://worldpopulationreview.com/countries

[ii] See https://stats.bis.org/statx/srs/table/d1

[iii] See https://stats.bis.org/statx/srs/table/d5.1 and https://stats.bis.org/statx/srs/table/d5.2

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated.

Copyright © Goldmoney Inc.

https://www.lewrockwell.com/2022/08/alasdair-macleod/geopolitics-the-world-is-splitting-into-two/