Read full text: https://voxday.net/2024/12/29/no-meritocracy-without-nationalism/

With apologies to Lee Kuan Yew: “In multiracial societies, you don’t hire in accordance with your economic interests and social interests, you hire in accordance with your race and religion.”– Vox Day Despite its grandiose and universalist pretensions, ideology is ultimately nothing more the detailed rationalization of an identity group’s immediate interests, and it will […] voxday.net |

With apologies to Lee Kuan Yew:

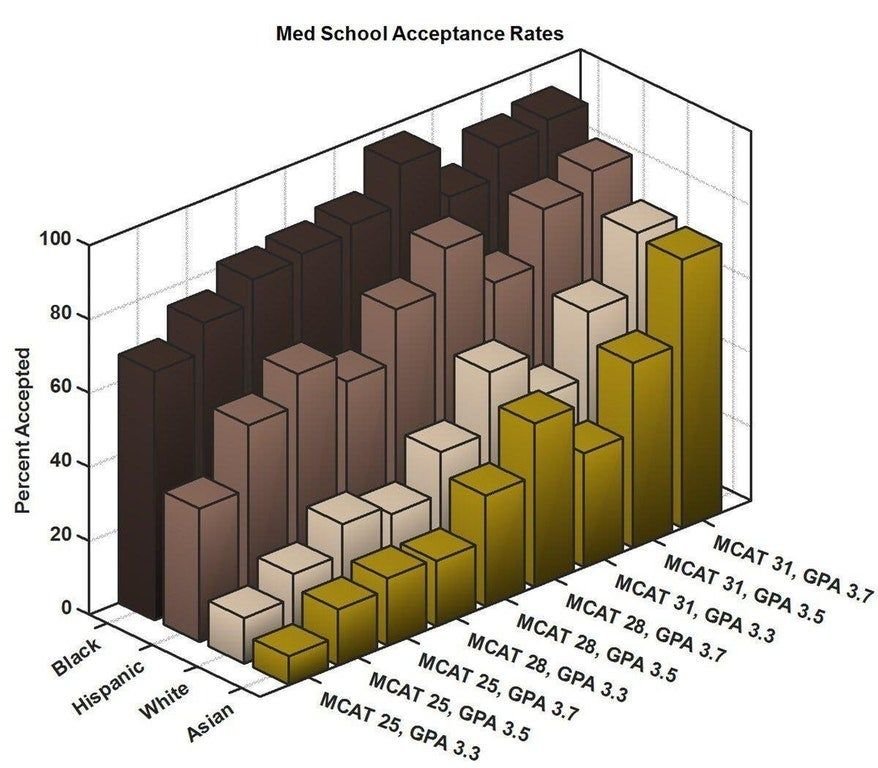

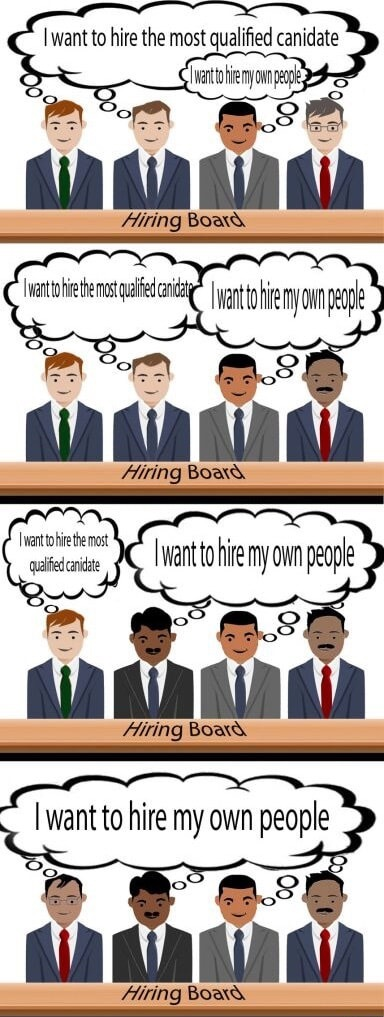

“In multiracial societies, you don’t hire in accordance with your economic interests and social interests, you hire in accordance with your race and religion.”

– Vox Day