When some think of the economy, they think of GDP. When I think of the economy, I try to visualize the average Joe and how he or she is doing.

According to Federal Reserve Governor Lael Brainard:

Overall, the U.S. economy remains on solid footing, against the backdrop of the first synchronized global economic growth we have seen in many years and accommodative financial conditions.This benign outlook is clouded somewhat by uncertainty about government funding and the fiscal outlook, and geostrategic risk has risen ….. Of course, the likely economic effects of Hurricane Harvey raise uncertainties about the economic outlook for the remainder of the year.

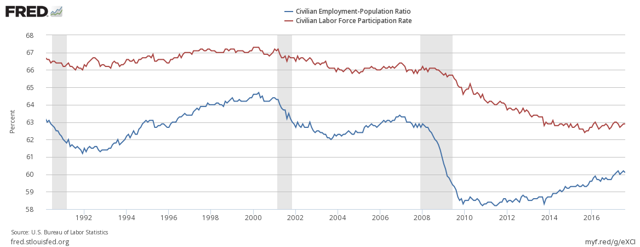

Yes, employment seems to be improving (I look at employment-population ratios) – although it remains far from excellent.

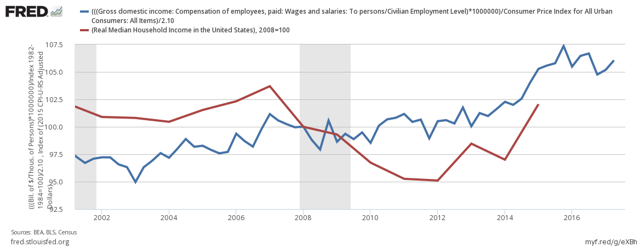

And average wages (blue line in graph below) seem to be improving (really difficult to monitor median incomes in real time). It’s all good if you have a job.

Indexed Real Wages and Salaries (Q1 2008 = 100) Per Employee

The red line on the above graph is real median household income which lags over one year.

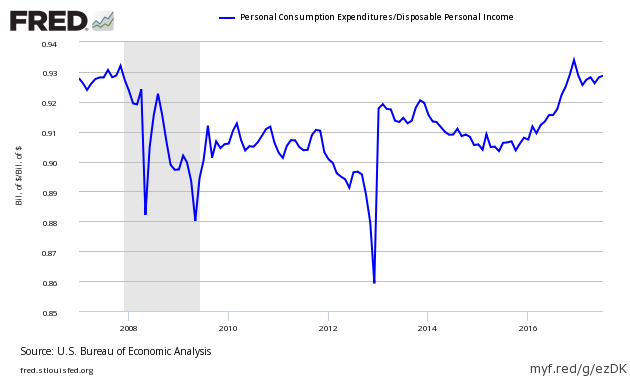

But the chart which concerns me is consumption versus spending.

The ratio of spending to income has been very elevated since September 2016. There have been only three extended periods in history where the ratio of spending to income has exceeded 0.92 (the months surrounding the 2001 recession, from September 2004 to the beginning of the 2007 Great Recession, and since September 2016).

Seasonally Adjusted Spending’s Ratio to Income (an increasing ratio means Consumer is spending more of Income)

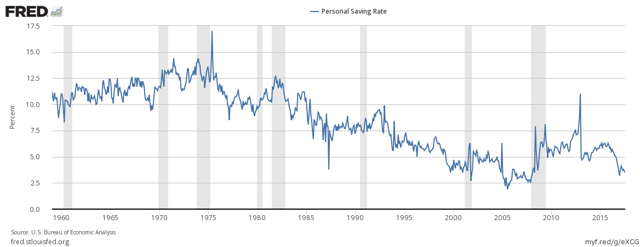

And personal savings rate nears historic lows.

Seems to me the average Joe is living from hand-to-mouth with little left over.

This kind of trend increases financial inequality – and tends to create a big brother government which assists the average Joe to survive.

The American middle class has been rotting away for decades..

The Top .01% is not sharing the wealthy with the bottom 50% income earners, which has produced massive wealth inequality gaps. Such gaps usually happened around an economic and social crisis.