The consensus holds there will be another bubble after the Everything Bubble pops, but this might be misplaced confidence in the godlike powers of central banks.

The consensus holds that central banks--the Federal Reserve in the US--will gradually inflate away the world's rising debt burden while propping up assets and the economy with the usual bag of monetary magic: suppress interest rates so debt service costs ease, increase the money supply and credit to prop up asset bubbles in stocks and housing, and thereby generate growth in consumption via the elixir of "the wealth effect:" as assets loft higher, everyone feels richer and so they borrow and spend more.

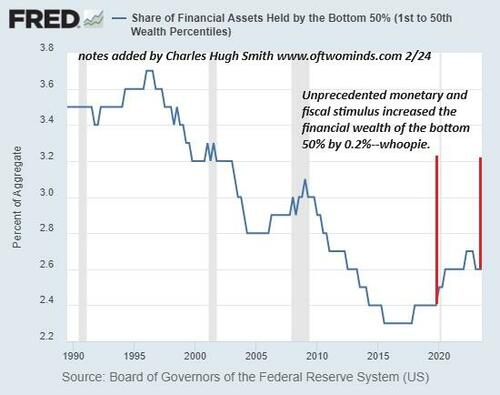

Well, not everyone, because only the top 10% own enough assets to feel "the wealth effect," but since they account for 50% of all consumer spending, that's enough to maintain the status quo, in which the bottom 90% lose ground (especially the bottom 60%) and the top 10% are doing splendidly......

....It is not coincidental that the peak of money velocity in the mid-1990s Internet boom aligns with the peak of wage growth and the bottom 50%'s share of financial net worth. Simply put, the 1990s were the last era of widespread prosperity of the sort that actually "trickled down" to the bottom 90%. This was also the last era in which housing was broadly affordable to households with average incomes.

Saying that money velocity is an indicator of economic catastrophe doesn't go over well in polite company, but there it is. Somebody barfed in the punchbowl, sorry about that.