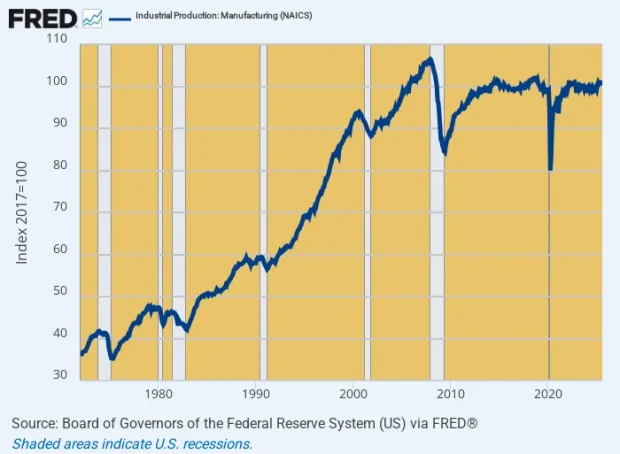

You can bet the 12 purported geniuses on the FOMC, who today came up with a 25 basis point cut in the essentially phony Fed funds rate, have never looked at the graph below. It shows that for all their wild-ass money printing in recent years, the US index of manufacturing output stands at 101.39, which is nearly 5% below the level reached on the eve of the financial crisis in December 2007.

That’s right. The US manufacturing economy has been shrinking in real physical terms for the past 18 years notwithstanding the fact that during that interval the Fed has printed nearly $6 trillion in brand, spanking new money that it snatched from thin air. So something big and bad happened after the Fed went all in on money-printing in response to the stock market meltdown in the fall of 2008.

After all, during the 28 years between 1972 and 2000 the very opposite occurred. Manufacturing output in the US rose by nearly 150%, which computes to a 3.3% growth rate per annum.

Yet there is no mystery as to why manufacturing output abruptly went flatter than a board after the Financial Crisis: To wit, the mad money-printers in the Eccles Building simply inflated the bejesus out of the US economy at a time when what was urgently needed was a stern deflation of an already inflation-bloated industrial sector.

US Manufacturing Output, 1972 to 2025

Here’s the thing. The price of a Pilates studio session or dentist visit is mainly driven by supply and demand balances in local markets, but with today’s shipping and communications technology the manufacture of durable goods is subject to ferocious global competition. Indeed, when you look at the current fully loaded (for fringes and benefits) wage rates among major foreign suppliers, it is no wonder that output of US manufactured goods has flat-lined......

The USA has priced itself out of the global manufacturing market, which is exactly why America has been running chronic and massive trade deficits that reached the staggering annual level of $1.2 trillion in 2024. Indeed, the collapse of America’s trade balance has been relentless over the last 30 years—with the deficit rising by 10X, from $10 billion to $100 billion. Per month!

And, no, POTUS, foreign trading partners did not suddenly turn into ever worsening unfair trade cheats in the last three decades. The cause of the plunging line below is domiciled on the banks of the Potomac, not in foreign capitals.