Ben Norton, Inflation and banking 2022 Economist Michael Hudson discusses the global inflation crisis and how the US Federal Reserve quietly (and apparently illegally) bailed out big banks in 2019 with $4.5 trillion of emergency repo oans Reproduced with the permission of Michael Hudson.

I interviewed economist Michael Hudson to discuss what is causing the global inflation crisis, and also how the US Federal Reserve quietly bailed out big banks in September 2019 with $4.5 trillion of emergency repo loans that appear to have blatantly violated the law.

TRANSCRIPT

BENJAMIN NORTON: Hey, everyone. This is Ben Norton, and I’m joined by a friend of the show, one of our favorite guests, Michael Hudson, the economist. His reputation precedes him; many of you probably know him. You can go to and check out his excellent articles and his books.

We had him on a few months ago to talk about the new, third edition of his book Super Imperialism: The Economic Strategy of American Empire. And today we’re going to talk about the inflation crisis around the world.

In the US in 2021, there was inflation around 7%, and this has led to a lot of discussion about what is causing the inflation, why there’s inflation.

Professor Hudson has pointed out for many years that inflation in the US and other countries is often measured in a very strange way that doesn’t include housing prices, and it doesn’t include what he calls the FIRE sector: finance, insurance and real estate.

So today we’ll talk about the rising rates of inflation and what corporate media outlets are missing about the story.

But before we begin talking about that, Professor Hudson, another reason I wanted to have you today is to talk about a big story that went viral. It was just published, and it’s on the website Wall Street on Parade. It went so viral that the website actually went down, because it was being shared so much.

This is an article just published at Wall Street on Parade. I have it up in the archive because the website is down. And the article is titled, There’s a News Blackout on the Fed’s Naming of the Banks that Got Its Emergency Repo Loans; Some Journalists Appear to Be Under Gag Orders. And this is by Pam Martens and Russ Martens, published on January 3.

I’ll just briefly summarize the main point, and then I want to get your response, because I think this is obviously part of the discussion around the inflation crisis.

“The Federal Reserve released the names of the banks that had received $4.5 trillion” – that is trillion with a T – “in cumulative loans in the last quarter of 2019 under its emergency repo loan operations for a liquidity crisis that has yet to be credibly explained.”

So Professor Hudson, I’ll ask you in a second to explain what that liquidity crisis was. And they point out that, among the borrowers that received $4.5 trillion in loans from the Fed were JPMorgan Chase, Goldman Sachs, and Citigroup, “three of the Wall Street banks that were at the center of the subprime and derivatives crisis in 2008 that brought down the U.S. economy.”

“That’s blockbuster news. But as of 7 a.m. this morning (January 3), not one major business media outlet has reported the details of the Fed’s big reveal.” And they suspect there are some journalists under gag orders.

And then the other point to add here is that this borrowing was happening in September 2019, and it was actually before the first case of Covid was identified in the United States. They point out that the first Covid case was reported in the U.S. in January, and then the World Health Organization declared a pandemic in March 2020. This massive borrowing spree of $4.5 trillion was happening in September.

So there are a few things you can respond to Professor Hudson. Maybe we can start with, why was the Fed giving trillions of dollars to these large Wall Street banks. And why was there a liquidity crisis? That’s unexplained.

Why did the Fed refuse to release the names of these banks? And was there a financial crisis before Covid that the U.S. government later was able to blame on Covid, but it was actually a financial crisis in the making?

MICHAEL HUDSON: There was actually no liquidity crisis whatsoever. And Pam Martens is very clear about that. She points out the reason that the regular newspapers don’t report it is the loans violated every element of the Dodd-Frank laws that were supposed to prevent the Fed from making loans to particular banks that were not part of a liquidity crisis.

In her article, she makes very clear by pointing out these three banks, Chase Manhattan, Goldman Sachs – which used to be a brokerage firm – and Citibank, that the Federal Reserve laws and the Dodd-Frank Act explicitly prevent the Fed from making loans to particular banks.

It can only make loans if there’s a general liquidity crisis. And we know that there wasn’t at that time, because she lists the banks that borrowed money, and there were very few of them.

There were the big three that she mentions. There was also Nomura, that got one-third of the loans in that order that were taken out. I think, on balance, the repo loans were like $20 billion and Nomura got $10 billion of them. And Cantor Fitzgerald was also in there.

Well, what happened, apparently, was that while the Dodd-Frank Act was being rewritten by the Congress, Janet Yellen changed the wording around and she said, “Well, how do we define a general liquidity crisis?” Well, it doesn’t mean what you and I mean by a liquidity crisis, meaning the whole economy is illiquid.

She said, “If five banks need to borrow, then it’s a general liquidity crisis.” Well, the problem, as she points out, is it’s the same three big banks, again and again, and again and again.

And these are not short-term loans. She points out that they were 14-day loans; there were longer loans. And they were rolled over, not overnight loans, not day-to-day loans, not even week-to-week loans. But month after month, the Fed was pumping money into JP Morgan and Citibank and Goldman.

But then she points out that, or at least she told me, that these really weren’t Citibank and Morgan Chase; it was to their trading affiliates. Now this is exactly what Dodd-Frank was supposed to prevent.

Dodd-Frank was supposed to protect the depository institutions by trying to go a little bit to restore the Glass-Steagall Act that Clinton and the Obama thugs that came in to the Obama administration all got rid of.

It was supposed to say, “OK, we’re not going to let banks having their trading facilities, the gambling facilities, on derivatives and just placing bets on the financial markets – we’re not supposed to help the banks out of these problems at all.”

So I think the reason that the newspapers are going quiet on this is the Fed broke the law. And it wants to continue breaking the law.

And that’s why these Wall Street banks fought so hard to get the current head of the Fed reappointed, [Jerome] Powell, because they know that he’s going to do what [Timothy] Geithner did under the Obama administration. He’s loyal to the New York City banks, and he’s willing to sacrifice the economy to help the banks.

Because those are the clients of the New York Fed, the big New York banks. And that’s been the case ever since I was on Wall Street half a [century] ago.

And Pam [Martens] is trying to expose how these banks are crooked, and really what the whole problem was. She points out that the Fed is supposed to make short-term loans, but these are long-term loans.

And the banks are not structurally insolvent. Without them, they would have lost money. The FDIC could have come in and taken them over. And the depositors, the insured depositors, would have been OK, which is just exactly what Sheila Bair, who was head of the Federal Deposit Insurance Corporation, wanted to do under Obama, when she was blocked by Geithner.

She sat with Geithner and Obama, and he said, “Look, I’m backed by the banks; forget the voters. Banks are my campaign contributors.” And he bailed out the banks and sacrificed, pushed the whole economy into what is now a 12-year recession basically, that is not improving at all.

So what is happening now is part of the whole quantitative easing bit that has really been a disaster. And the crisis is the Fed is flooding the financial markets with credit in order to increase real estate prices, to increase mortgage lending, to enable the banks and the 1%, that own the private capital funds and the insurance companies and the banks, to continue making money.

And the reason that that these three banks were bailed out was they had made bad bets against, apparently, insurance companies, and foreign banks. Apparently MetLife, and Prudential, and other insurance companies made bets as to which way the stock market would go, and they won and Chase lost, Citibank lost, and Goldman Sachs lost.

And somebody else must have lost because in September of 2019, when all this was occurring, the overnight rate went up to 10%. Well, that means that someone had really made a bad bet and was technically on paper insolvent, and that nobody would lend to them.

For 10% overnight money, that means that nobody’s going to lend to you. Everybody knows that you’re insolvent. And that was all hushed up at the time. Not a word of it in the paper.

And this is such a touchy subject that, if the banks would begin to – if the newspapers and the media would begin to get into the explanation of how all this developed, that would sort of counter the whole Fed’s strategy, and the whole Democratic Party strategy, which is to support Wall Street, not the economy at large.

BENJAMIN NORTON: And Professor Hudson, what you’re getting at here is that, these banks were engaged in very risky behavior. And essentially all of the indications appear to be that they kind of unleashed a financial crisis in late 2019.

And then with the pandemic, they could conveniently blame it in the pandemic. I’m not saying – obviously, they didn’t cause the pandemic. But I’m saying that it was actually, in some ways, it was actually a savior for them, a life saver, because then they could say, “Oh, well, we didn’t cause a financial crash; it was the pandemic.”

But we actually see signs that, in late 2019, before Covid even arrived in the United States – well, there’s even discussion about that, but before the first official case of Covid was identified in the United States – there was already a financial crisis, apparently, and the Fed was just trying to cover it up.

MICHAEL HUDSON: Well, the problem is that the Fed made sure that it didn’t have to release any of this data for two years, on the theory that after two years, nobody can remember what’s happening and it doesn’t matter anymore; it’s yesterday’s news.

And so the material only just came out now. We’re always going to be two years behind. And if you’re two years behind, then the thieves are going to have plenty of time to cover up what they’ve done, borrow even more money, and it’ll be too late to do anything.

The whole idea is not to make the Fed transparent, to make a wall of secrecy around the Fed, so that it can do with its pet banks, and bail out the banks that most Americans don’t think should have been bailed out by Mr. Obama in 2009, and certainly don’t think that they should be bailed out now, as long as the depositors and the regular companies in the real economy is kept safe.

But the Fed isn’t saving the real economy. It’s saving the gamblers.

BENJAMIN NORTON: And Professor Hudson, there’s an incredible line, an incredible paragraph in this article that I want to get up here, that says a lot about not just the US economic system, but also the media.

The last paragraph of this piece : “Why might such an outcome be a problem for media outlets in New York City? Three of the serially charged banks (JPMorgan Chase, Goldman Sachs and Citigroup) are actually owners of the New York Fed – the regional Fed bank that played the major role in doling out the bailout money in 2008, and again in 2019. The New York Fed and its unlimited ability to electronically print money, are a boon to the New York City economy, which is a boon to advertising revenue at the big New York City-based media outlets.”

I didn’t know – it’s pretty incredible. I knew that, obviously, the Fed is this kind of public-private, complex – whether or not it’s public or private, I know that people say it’s neither and both. So it’s confusing. Maybe you could explain that.

But I didn’t know that JPMorgan Chase, Goldman Sachs, and Citigroup are owners of the New York Fed.

MICHAEL HUDSON: Well, technically the Fed stock – all the banks have to own Federal Reserve stock; so it doesn’t matter that they’re owners. The ownership isn’t all that important for the Fed. Because the Fed is really a government organization. But the problem is that Wall Street has taken over the government.

And it has taken over the Fed not through its ownership; it doesn’t have shares to vote as to who is going to be the head. The heads are appointed in Washington; they’re appointed by Congress.

I talked to Pam [Martens] about that and she said because her site was so overloaded, she couldn’t get on it to write more last night, when it was up. And she has other theories.

I thought that it’s the tail wagging the dog to say, well, look, it’s about advertising. The banks don’t do that much advertising, and nobody is going to kill a whole big story like this for the ads.

And so, when we talked, she said she thinks part of the problem is margin loans. I mean, there are all sorts of problems that could have happened there.

And the banks have been, again, operating if not illegally, then, let’s say, stretching the envelope, by pretending that what really are margin loans to help people buy stock are really disguised, or somehow their lawyers have drawn up these contracts as derivatives contracts.

And a derivative you can lend 50% against, instead of just 15% for margin loans. So the banks actually have been working around the whole spirit of the law to make much larger loans than they should have.

And when the stock market, as you have been watching, back then is doing what it’s doing today; it’s zigzagging, up and down, and up and down in a zigzag. That’s how you make money: Push it up, computerized buying; push it down, computerized selling.

And one part of it was other banks venturing not only into derivatives but into the margin loans.

I don’t think the ownership can control management. It’s not that Citibank and Chase can say, “Well, we own the majority stock in the Fed, so we’re just going to appoint one of our own guys as manager.”

They don’t have to. They’ll give money to the Biden administration, and Biden will appoint their people.

So the Fed is really controlled by the government, and all you have to do is give a campaign contribution to the government, and you get whatever you want.

And I think Pam [Martens] would agree with that analysis. So that really should be the emphasis, not the banks, not that the New York Times is after more advertising money from Chase.

I think there is more bank advertising on television than there is in the newspapers.

And also, I think the the older reporters that used to know how to read a financial balance sheet, they’re all retired or they’re not working anymore.

Or if they get too close, too embarrassing, and write columns like Pam [Martens] does, all of a sudden, they’re not working for the same organization anymore.

So I think people just don’t understand what a repo is, how it’s connected to the money supply – and it isn’t – how it’s connected to quantitative easing. There is just a general economic illiteracy

Because if you get an economics degree in academia, they don’t talk about money, or debt, or credit. None of this appears. None of this is in your money in banking course. It’s all sort of a Mickey Mouse.

Walt Disney Happy World, where nothing like this occurs.

And so how is a reporter going to know how to do the research that Pam goes into year after year? Taking apart all these balance sheets and doing all the analysis you have to do to net out what’s actually happening from the whey.

When IBM was fighting an antitrust suit – this must have been 50 years ago – and the government wanted some information from it, IBM through, “We’ve got to give the government information. What are we going to do?”

So it gave two huge storerooms of hard printout of information that would have taken five years to go through.

Well that’s what the Fed did with these statistics. It gave such a mass of information that you had – it was like looking for a needle in a haystack in order to find it.

And as newspapers have been run more like profit-making companies, they have cut the costs. They don’t have the time to do the research to find the needle in the haystack.

And since Pam [Martens] doesn’t work for a newspaper that’s under that cost constraint, she knows just what she’s looking for and goes right to it.

BENJAMIN NORTON: And Professor Hudson, let’s talk about the inflation crisis and if this is related to it.

We we had you on in early 2020 to talk about the CARES Act, and the so-called bailout, that was, as you said, basically a multi-trillion-dollar giveaway to the financial sector.

And I believe that’s an addition to the $4.5 billion in the repo loans that we’re talking about.

MICHAEL HUDSON: Yeah, that wasn’t the Federal Reserve; that was Treasury spending, not the Federal Reserve. They’re completely separate.

BENJAMIN NORTON: Exactly. So we’re talking about over $10 trillion, between the two, over $10 trillion that went to the financial sector in the span of less than a year, in six months or so, from late 2019 to early 2020.

Do you think that that is one of the main reasons for the inflation?

I want to preface by saying that a point that you often stress, which I think is important to keep in mind, is that, the way inflation is measured frequently, at least in the United States, is that it doesn’t include things like the housing sector.

And you have often pointed out for years that there has been a lot of inflation over the past several years in the FIRE sector. And real estate prices are a clear example of that. But that’s not considered the consumer price index.

So go ahead.

MICHAEL HUDSON: It actually is included, but in a very moderate way, modest way. I’ve looked at the Fed statistics on rent as a portion of income and mortgage payments as a portion of income. And in the last 30 years, there’s been zero change, according to these statistics. Absolutely flat.

So they decided what the percentage was; they haven’t changed it at all. The consumer price index doesn’t recognize the increase in either rental costs or mortgage costs as housing prices have risen. So they’re under-reported.

But more important, people have had to change what they’re eating and what they’re buying.

But it’s certain, the money that the Fed gave to individual families under the CARES Act, almost all of that was used to pay down debt.

Because the way the Treasury made the payments was to credit either their credit cards or their bank accounts. And that most Americans are overdrawn on their bank accounts, or they owe money on their credit cards.

And the money went right out of their hands to reduce the volume of debt they had. And essentially, it was a debt repayment to the bank.

That was what happened to most of the CARES Act. It wasn’t spent on goods and services, and so it wasn’t inflationary. Just the opposite.

So there are a number of reasons why prices have gone up.

The big reason is, if you look at the prices that have gone up, they’re monopoly prices. The monopolies have been able to charge more because they’re monopolies, and because there’s less and less competition, and because the government is not really enforcing anti-monopoly legislation.

President Biden is trying to increase that now, but it’s going to take a little while before the prosecution of monopolies and talk of break-ups really concludes.

Also there are a lot of bottlenecks in transportation, as you’ve heard. There are two kinds of bottlenecks: One, you’ve heard about the port in Los Angeles, over the ships. The shipping costs have tripled from Asia to the United States.

The ships are unable to unload because the ports are not organized as ports. Particular companies own the trucks; other companies own the containers; other companies own the ships.

And there is no way to reconcile them to get the containers that are offloaded from the ships once they’re emptied out, there’s no way to get them back. You have to get them back to particular terminals, and it’s not designed by anybody who is competently put there.

The one benefit to the whole economy of all this is that it means that there’s no chance that the secretary of transportation, Mayor Pete [Buttigieg], can ever show his face in public again. But that’s sort of a minor gain.

The other fact is that in companies, there’s a new management philosophy that’s come in, maybe about 15 years ago, and that’s called just-in-time inventory.

In other words, the idea is, you want to cut – the less you spend on inventories, the more money you have to pay out as dividends to your stockholders.

If you don’t have to spend money on inventories, then your profit rates go up, and you can pay more.

And so companies say, “Let’s operate with almost no inventories at all. That way, we’ll have a little bit more money to push up the stock price.” And if you’re the CEO, you get your bonus paid on the stock price.

Well, the problem is that the purpose of inventories is to prevent zigzags in prices, when there are shortages. If there is a supply problem, well, you have enough inventories on hand so that you are not going to have a crisis.

That’s why the United States has a national inventory of oil, and fuels, and national reserves of things that the government and the economy needs.

But Walmart, and other stores, and distributor retail stores don’t operate in the same way for the economy. They’re after profits. So they didn’t have any inventories.

So a little bit of a shortage all of a sudden caused a massive scramble to try to get enough goods to sell to people. And so it’s that just-in-time budgeting.

And also, of course, there are labor shortages from Covid. People are finally beginning to get almost half of the minimum wage; some people are almost able to earn the minimum wage now.

Where there is a real labor shortage, in New York City, the transport authority said it’s paying its workers an extra $35,000 to retirees, if they’ll sign on for three months to get over the current shortage.

So a little bit is, finally, the class war against labor is alleviated because of the crisis. So those are the real reasons of inflation.

It’s not a monetary inflation, except for the financial inflation of housing prices, and the fact that it has created so many multi-billionaires by the Fed’s quantitative easing, that they’ve all created private capital buyout funds, and they’re buying up all the housing and outfitting the owner occupants that want to buy housing, to take over the housing, turn it into rental housing, and charge cutthroat rents to the economy.

BENJAMIN NORTON: Yeah, it’s pretty interesting, Professor Hudson, because if you listen to Fox News, or a lot of right-wing analysis, they say that the problem behind the inflation is that the Biden administration is just spending so much money, and he’s a socialist, and he’s funding all of these programs, and Build Back Better.

And it’s hilarious because, meanwhile, his own party won’t even approve the watered down version of Build Back Better, which is like every few weeks there’s a trillion dollars less, and then less spending, and less spending.

So it’s pretty funny considering that his own party is preventing social spending, and then Republicans are claiming that he’s doing all this social spending, which is creating inflation.

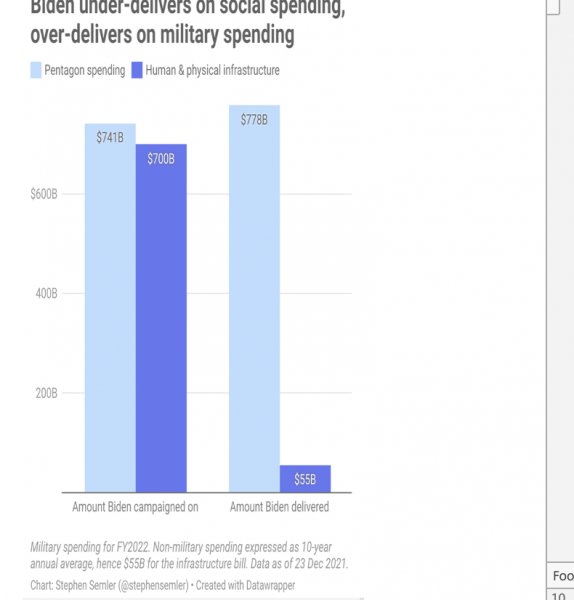

I want to point out a graph, an analysis that was done by this really good analyst named Stephen Semler; he’s got a good Substack where he focuses on the Military-Industrial Complex.

And he did this study here called “Biden over-delivered on military spending and under-delivered on social spending.” And here this graph really visualizes the disparity, where Biden, when he campaigned, he pledged $700 billion for human and physical infrastructure and has only delivered $55 billion, a tiny fraction.

And he campaigned pledging $741 billion for the Pentagon and just delivered a $778 billion dollar military budget.

So while the right wing is freaking out and claiming that Biden is a socialist, spending all this money on social programs, in fact that money is going toward increasing the military budget, and not going to social programs. I don’t know if you wanted to comment on that.

MICHAEL HUDSON: Sure, I think that Schumer has a great influence over the Republican Party, and I think Schumer and Pelosi meet with their counterparts at the Republicans and say, “Please call us a socialist. We’re not going to disagree with you.” Because they know that 85% of Americans like the word socialism.

And the more that Republicans call them socialist, that helps them solidify the base that really wants socialism, so that the Democratic Party can throw cold water on that and prevent socialism.

It’s a great scam.

BENJAMIN NORTON: That’s an interesting point; it’s an interesting idea.

MICHAEL HUDSON: But actually, the Biden administration, they haven’t spend money into the economy. Spending money into the FIRE sector – the finance, insurance, and real estate sector – isn’t spending money into the economy; it’s spending money into the overhead that is preventing the economy from growing. Just the opposite.

And to be fair to Biden, he hasn’t followed through on any of his other campaign promises, either. He hasn’t cut back student debt like he promised. He hasn’t raised the minimum wage like he promised.

So it would be unfair to single out just the infrastructure. He has universally repudiated every campaign promise that he made, because his clientele are the campaign contributors, not the voters.

BENJAMIN NORTON: Yeah, excellent point. He also, according to a recent study just published yesterday, on January 3, he also has increased deportation of immigrant children by 30% compared to Trump. He didn’t end the war in Yemen; has continued selling weapons to Saudi Arabia.

Professor Hudson, you mentioned something important, that is quantitative easing. For those of us who are not economics experts. Can you explain what quantitative easing is?

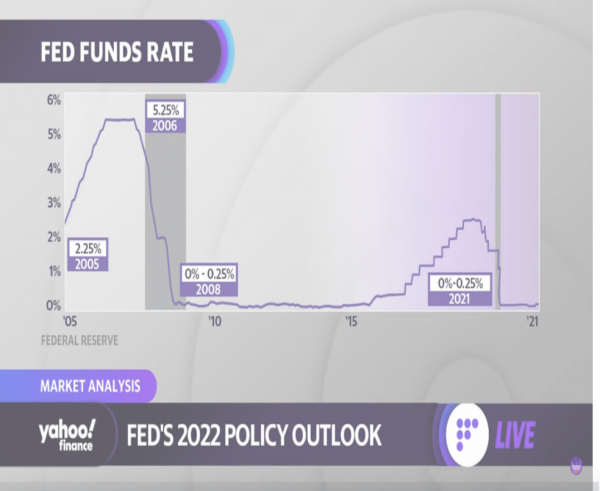

I just want to get this graph here. So before doing this interview, I wanted to listen to what kind of mainstream business news outlets were saying. This is a graph from Yahoo Finance. And they were talking all about the Fed interest rate, and they said that the Fed is planning on increasing the interest rate three different times this year, potentially.

And you can see a graph here of close to zero interest from around 2008 until really 2020 or so.

So it does look like it might be slightly increasing interest rates, but do you think that’s smoke and mirrors, or do you think that’s actually a significant factor?

MICHAEL HUDSON: Quantitative easing is a significant factor because it has been a huge subsidy to the financial sector. It’s a bad term. It was supposed to be – what quantity is easing? Not the money supply, because all this is occurring on the Fed’s balance sheet.

It means that the Fed is letting banks pledge their junk mortgages, their bonds, and their stocks in exchange for Federal Reserve deposits that they can use to increase their lending base. And the official original reason in 2009 was the Fed said, we’ve got to have higher housing prices.

Americans are only spending maybe 35% of their rent of their income on rent and housing. We’ve got to increase that to 43%. So if we can lower the interest rates, people can take out larger and larger mortgages, and there will be a huge flood of lending into the mortgage market, and Americans will have to pay more for their housing. And that will make the banks richer, the insurance companies richer, and our clients in the financial sector richer.

So quantitative easing was designed to increase the price of housing to Americans, and then it was to create a huge stock market boom.

And the banks had lost so much money through their junk mortgage lending and their insurance, their plain fraudulent loans, as Bill Black has pointed out at University of Missouri at Kansas City, that they said, “We’ve got to have the banks make back the trillions of dollars they’ve lost. And so we’re going to have quantitative easing to give them enough money to gamble with, that they can make money at the expense of the public at large, and the pension funds, and other people.”

So quantitative easing was part of the war of the financial sector against the economy at large.

And it just provides a lot of credit. If you have interest rates at 0.1%, then you can buy stocks that are yielding 5% or 7% or 10%, or you can borrow at 0.1% and buy a junk bond. And junk bond rates went down from about 15%, down to maybe 5% today. It’s all arbitrage.

People are borrowing low from the Fed and from the banks that borrow from the Fed to essentially buy higher yielding securities. And this is this is what has pushed up the stock market.

It’s not going up because the economy is getting better. It’s going up because the Fed has been inflated.

The Fed’s aim is inflation. But it doesn’t want to inflate the economy, real prices, it wants to inflate stock and bond and real estate prices, for the 1%. So essentially, this is part of the war of the 1% against the 99%.

They’ve got almost all the growth in wealth since the pandemic began. There has been about, I think, $1 trillion growth, more than that, in the private wealth.

All of this wealth that has been created has been basically taken by the 1%, who have made it financially, through financial capital gains, rising prices for their stocks, bonds, and real estate, not by the economy at large.

The economy at large, the 99%, have had to go further and further into debt during the pandemic. And once the moratorium on rent and mortgage payments expires in a month or so, there is going to be a huge wave of evictions, not only of renters, but even of homeowners that couldn’t afford to make their mortgage payments. And there’s going to be just a huge explosion.

Well, the Fed’s job in an election year is always to help re-elect the president. Whether it’s a Republican president or a Democratic president, it doesn’t matter because they’re basically the same party, but it’s always to re-elect the sitting president.

And so the Fed is not going to raise interest rates this year because once the Fed raises interest rates, then people are not going to borrow to buy stocks and bonds anymore. If they can’t make an arbitrage speculative gain by borrowing at 1% to buy a stock yielding 5%, they’ll sell the stock.

And if they sell the stock, it’ll go down. And at a certain point, the Fed is running a pump and dump operation, and we’re going to get to the pump stage, quantitative easing, to the dump stage, when the insiders will say, “OK, time to raise interest rates Fed. Let’s raise them now.”

They’ll sell out and the market will plunge, and people will say, “Nobody could have foreseen this.”

BENJAMIN NORTON: Yeah, Professor Hudson, the kind of conventional bourgeois economics wisdom, if you’re just reading the business press, is that when there’s high inflation, the Fed should increase interest rates.

And my understanding, at least according to reading the kind of conventional business press, is that the reason the Fed, at least the reason they claim, that the Fed reduced interest rates so low after the crash of 2008 was to help the economy grow.

You can see the graph here showing the Fed interest rate, and it’s been pretty static, at close to 0%, really until the pandemic, and its slightly increased.

But still even compared to the 1990s, when the interest rate was around 5 or 6%, or in the 1980s when the interest rate fluctuated, but was almost as high as 20%.

I mean, even though the Fed has slightly increased interest rates recently, or it’s still talking about a fraction of 1%. It’s nothing compared to what the interest rates have been in the in the 1980s.

So why is why is it? I mean, I think it’s pretty clear, given the answer you just said, but maybe you can further expand.

What is the excuse they’re giving for not increasing interest rates further, if they want to supposedly combat inflation?

MICHAEL HUDSON: They don’t have an excuse. They have a pretense. They have a cover story. And the cover story is trickle-down economics: We’ve just made enormous billions, trillions of dollars for the 1%, and it’s all going to trickle down. None of this has been spent into the economy, and they say, “We don’t have to spend it in the economy.” The Treasury doesn’t need Biden’s Build Back Better plan.

All we need is to make more stock market gains and the 1%, maybe say the 10% of the population that owns most of the stocks, now they’ll have enough money to buy more Andy Warhol etchings, and rare art, and expensive wines, and things like that, and it’ll all trickle down.

That’s not really an excuse; it’s so unrealistic; it’s parallel universe talking. But that’s the cover story. And it’s backed by everything that economics students are taught when they get an economics degree in the university.

So who’s to puncture their balloon and say, “Wait a minute, here’s what’s really happening”? Well, you know your show; you have Pam Martins’; you have a couple of other sites.

But the economy is living in a dream world, and propaganda is the name of the game.

BENJAMIN NORTON: Professor Hudson, let’s switch topics a bit here. I want to talk about an issue that we frequently address with you, I think it’s very important, and that is de-dollarization.

This is an interesting article that was just published in Nikkei, which is a Japanese website focused on business. This is Nikkei Asia.

And they have this article just published December 29, Central banks accelerate shift from dollar to gold worldwide : ”They say “holdings rose to a 31-year high in 2021.”

The dictatorship of the US dollar is weakening: “Central banks around the world are increasing the gold they hold in foreign exchange reserves” Central banks have built up gold reserves by 4,500 tons over the past decade, to the highest level since 1990.

Let me summarize a few of the main points here. They say, “Central banks around the world are increasing the gold they hold in foreign exchange reserves, bringing the total to a 31-year high in 2021.” And they “have built up their gold reserves by more than 4,500 tons over the past decade.”

As of this September, this past September 2021, the reserves totaled 36,000 tons, the largest since 1990, and up 15% from a decade earlier.

So why do you think central banks are are shifting to gold?

MICHAEL HUDSON: They’re protecting themselves against US political aggression. The big story last year was – if a country keeps its reserves and US dollars, that means they’re holding US Treasury securities. The US Treasury can simply say, “We’re not going to pay you.”

And even when a country like Venezuela tried to protect itself by holding its money in gold, where is it going to hold it? It held it at the Bank of England. And the Bank of England said, “Well, we’ve just been told by the White House that that they’ve elected a new president of Venezuela, Mr. Guaidó. And we don’t recognize the president that the Venezuelans elect, because Venezuela is not part of the US orbit.”

So they grabbed all of Venezuela’s gold and gave it to the basically fascist opposition, to the ultra right-winger. The Americans say, “We’re going to recognize an opposition leader; we’re going to pick him out of thin air and take all the money away from Venezuela.”

Countries all over, from Russia to China to the Third World, think the United States is going to just grab our money, any time at all. The dollar is a hot potato, because the US, basically, it looks like, is prepping for war over the Ukraine; it’s prepping for war with Russia; it’s prepping for war with China.

It has declared war on almost the entire world that does not agree to follow the policies that the State Department and the military dictate to it.

So other countries are just scared, absolutely scared of what the United States is doing. Of course, they’re getting rid of dollars.

The United States said, “Well, you know, if we don’t like what Russia does, we’re going to cut off the banking contact with the SWIFT, the interbank money transfer system.” So if you do hold your money in dollars, you can’t get it.

I guess the classic example is with Iran. When the Shah was overthrown. Iran’s bank was Chase Manhattan Bank, which I was working for, as a balance-of-payments analyst.

And Iran had foreign debt that it paid promptly every three months, and so it sent a note to the bank, “Please pay our bondholders.” And Chase got a note from the State Department saying, “Don’t do what Iran wants; don’t pay.”

So Chase just sat on the money. It didn’t pay the bondholders. The US government and the IMF declared Iran in default of paying, even though it had all the money to pay the bondholders.

And all of a sudden, they said now Iran owes the entire balance that’s due, on the theory that if you miss one payment, then you default, and we’re going to make Iran do what the Fed didn’t make Chase Manhattan, and Citibank, and Goldman Sachs do. They couldn’t pay and transfer, but they weren’t pushed under bankruptcy.

So by holding your money in the US bank, the US bank does whatever the government tells it to, and it can drive any country bankrupt at any point.

If other countries pass a tariff against US goods that the US doesn’t like, it can just essentially not pay them on whatever they hold in the United States, whether they hold reserves in American banks, or whether they hold reserves in the Treasury or the Fed, the United States can just grab their money.

And so the United States has broken every rule in the financial book, and it’s a renegade; it’s a pirate.

And other countries are freeing themselves from piracy by saying, “The dollar is a hot potato. There is no way that we can believe them. You can’t make a contract with the American government.”

Ever since the Native Americans tried to make land contracts in the 19th century with them, the United States doesn’t pay any attention to the contracts signed. And President Putin says it’s “not agreement capable.”

So how can you make a financial arrangement with a country whose banks and State Department and financial department are not agreement capable? They’re bailing out.

And what’s the alternative? Well, the only alternative is to hold each other’s currencies, and to do something that, for the last 2,000 years, the world has liked gold and silver, and so they’re putting their money into gold because it’s an asset that doesn’t have a liability behind it.

It’s an asset that, if you’re holding it, not England, not the New York Fed – the German government has told the New York Fed, “Send us back to the gold that we have on deposit there for safekeeping. It’s not safekeeping anymore.

Planeload after planeload of gold is being flown back to Germany from the U.S., because even Germany – satellite as it is – is afraid that the United States may not like something Germany does, like if Germany imports gas from Russia, will America just grab all its gold and say, “You can’t have it anymore; we’re fining you.”

The United States has become lawless. And so of course you can’t trust it; it’s like a wild cat bank in the the 19th century.

BENJAMIN NORTON: And Professor Hudson, something that you’ve talked about in our various interviews with you over the past few years, which proved to be very prescient, is that China and Russia were in the process of trying to develop a new financial architecture to get around the U.S.-controlled financial system.

And they have officially announced that publicly. Anyone who follows our show would have known that a few years ago, because you have been pointing this out for well over a year now.

But this is an article that was published this December in the Global Times, which is owned by the People’s Daily, so it’s very close to the Communist Party of China, and it represents the perspective of a certain wing of the Communist Party of China.

And the article is titled “China and Russia to establish independent financial systems<.” And they also quote Russian media; it was reported in RT as well.

Russia and China are developing an alternative to the US-controlled global financial system, to weaken US sanctions This will “deter the threat of the US government’s long-arm jurisdiction based on the US dollar-denominated international payment network.”

And very briefly, to summarize the article, they say that “Russia and China have agreed to develop shared financial structures to deepen economic ties in a way that will not be affected by the pressure of third parties.” And we all know when they say third parties, they mean the United States.

And they also talk about how this is to “deter the threat of the U.S. government’s long arm jurisdiction based on the U.S. dollar-denominated international payment network.”

And they also reveal that they’re trying to drop the dollar in their business, in the business that China and Russia do with each other.

And then here’s another article to complement this. This was in Turkish state media back in July of 2021: “<Russia accelerates de-dollarization move.

And they talk about how Russia at the St Petersburg International Economic Forum, President Putin accused the U.S. of using the dollar as a tool of economic and political warfare. And he said “the US will regret using the dollar as a sanctions weapon.”

And he pointed out that that Russia’s oil companies are trying to stop using the currency. And the country’s finance minister, Anton Siluanov, said Russia will completely divest its dollar assets in the National Welfare Fund.

And he said – this is a huge quote – “We have decided to get out of dollar assets completely, replacing investments in dollars with an increase in euros and gold.”

So this is something that you’ve talked about. Maybe do you have more insight on and the attempts by China and Russia to de-dollarize, and also to, at the same time, create a new financial architecture?

MICHAEL HUDSON: Think of it more as President Trump, followed by President Biden, forcing Russia and China to de-dollarize, by threatening explicitly – and that was made a month ago again – of cutting them off from SWIFT, the inter-bank transfer system, officially run out of Brussels, right at NATO headquarters.

And the idea is, when you write a check to somebody, you write a check, they put it in their bank; all that goes through the SWIFT system. Well, the SWIFT system covers basically the whole world.

It’s a computerized system so that banks can transfer money. You can send money to England, or to Russia or China; or Russia and China can send money back and forth.

Well, the problem they had is Trump and his secretary again and again and again threatened to cut Russia off from SWIFT.

The U.S. government kept saying, “We can create a crisis with you. We don’t have to bomb you. We don’t have to beat you militarily. We can just paralyze your financial system by cutting you off from SWIFT.”

So what they have done is say, “OK, I guess we’d better create our own financial clearing system and bank clearing system well enough that, if you close us down, we’ll have another parallel system ready to go.”

It’s as if you’re all using MasterCard and you want to shift the Visa, and you say, “OK, just in case the MasterCard decides it doesn’t like us, we’re going to use a Visa account to transfer money.”

So they’ve created their own alternative, ready to go.

It costs a lot of money to develop a huge computerized payment system. But since Russia, China, Iran, and the whole Asian grouping has decided, “Well, wait a minute, most of our payments are among ourselves. If China is paying Thailand, or South Korea, or Russia, buying and selling with them, why does it need to do it in US dollars and have a reserve that is lent to the US Treasury to essentially use the dollars to spend abroad and finance all of its military encirclement of these various areas?”

So they said, any dollars we hold, that’s a loan to the U.S. Treasury. And the loan enables the dollar to be spent on militarily encircling us, so they can say, “If you break away from the dollar, we’re going to use our military bases that we spent your dollars on to bomb you.”

So they’re breaking free of the whole dollar system. And that’s the whole premise of my book “Super Imperialism,” as we’ve discussed before on the show.

So that they’re decoupling from the U.S. economy as much as they can.

And in any case, they say, “Look, the U.S. economy is going down quickly. Both parties, Democrats, and Republicans, are in agreement that the economy has to shrink by about 20%, in order to pay all of the debts that the 99% owe to the 1%.”

So the U.S. economy is not going to be a very good market for it anymore. We don’t need it. It doesn’t need us. Let North America go its way; we’ll go our way. And that’s that’s exactly what’s happening in the world. There’s a global fracture.

BENJAMIN NORTON: Yeah, you referred to the recent crisis in Ukraine, where essentially NATO and the hardcore right-wing nationalists in Ukraine are really trying to cause this conflict in the Donbass region, in the east.

And then they’re falsely claiming that Russia is going to invade. I mean, this is all a pretense, of course, to justify further aggression against Russia and punitive actions.

And then recently, there’s been this discussion, that you acknowledged, of the so-called nuclear option, which is decoupling Russia’s economy, disconnecting the economy from the SWIFT system.

And when Russia and China announced their development of a new financial system, it was effectively in response to those news reports that the US government and the EU were talking about the “nuclear option” of removing Russia from SWIFT.

And what’s interesting is that Jens Stoltenberg, the secretary general of NATO, has made it clear that they’re not going to militarily challenge Russia over the Donbass, over Ukraine, that if there’s a military conflict – which would likely, by the way, be caused by Ukraine, not by Russia; Russia has made it very clear it has no intention of invading Ukraine – but if the hardcore right-wing nationalists in Ukraine decide they want to attack the Donbass. Russia has said that it would respond.

And then the response would be from NATO not military intervention, but disconnecting Russia from the SWIFT system, which they call the nuclear option.

Which is actually quite interesting, because it would be basically dropping a nuke on the US-controlled financial system, and would be the final straw that would officially decouple Russia and China from the US-controlled financial system.

I think it’s a very interesting moment, because we’ve had you on Professor Hudson for the past few years talking about this issue, of de-dollarization, the attempt to decouple the Chinese and Russian economies from the US- and the EU-dominated financial system. And we’ve really seen in the past few months, I think, an acceleration of that.

So do you anticipate – I mean, when people interview me, I hate when people ask me questions about the future, as if I can, you know, predict what’s going to happen – but given what’s happening right now politically with Ukraine – I mean, there are talks that are happening this week between the US and Russia, so it does seem that the Biden administration is trying to put some brakes on, to prevent this from accelerating further.

But do you think that this year, in the months that come, that we could actually see that nuclear option used, that Russia could be disconnected from SWIFT. And if it is, what would the consequences be?

MICHAEL HUDSON: Well it’s pretty late now because they’ve been talking about it now for so many years that Russia and China have had a chance to put in their own system.

Johnson’s Russia list is a list of all of the big articles in Russia every day. And if you’ve been following that, Russia has already said, “Well, yeah, it’ll be an interruption for a while. It’s not going to be like a nuclear bomb. It’ll be more like a stink bomb.”

So they’re going to drop a stink bomb on Russia, but that’s not the most serious thing in the whole world.

So Russia and China by now have had enough opportunity to protect themselves from this. But from what you said earlier – never, ever quote anything Stoltenberg says. His job is – I won’t even use the word.

But the Americans already have troops in Ukraine. Their special operation forces, they’re in Ukraine. The U.S. has already hired I guess what used to be Blackwater troops, mercenaries; they put them in Ukraine.

So the U.S. is fighting on the side of the Ukrainian Nazis against Russia. Russia said two weeks ago that the U.S. special forces were planning a false flag chemical attack, and it said the city and the time. And it said, if you do that, we’re just going to come in and bomb.

So Russia found out about it and it stopped the false flag attack. But the U.S. has forces there. They thought that somehow they could provoke Russia into actually invading.

I can guarantee you. I’m willing to lose my reputation if Russia actually invades Ukraine. It would be crazy. It doesn’t have the money to do it. It doesn’t have the troops.

And who needs Ukraine? Russia has no need for Ukraine. And it’s a basket case. It has the lowest living standards in Europe. And on every U.S. international report, it’s the most corrupt country in Europe. Nothing can be done to help at all.

Russia doesn’t have to attack it. All it has to do is let it – if somebody is committing suicide, you don’t stop it.

Russia did say that if there is a military attack on the Donbass, we are going to respond with missiles, and the missiles will not necessarily be linked to Ukraine. We may bomb, for instance, Romania, where NATO has missile launchers.

And Russia has made it clear you’re not going to go anymore with these salami tactics of moving NATO bit by bit. As far as Russia is concerned when America put special forces and troops there, when America gives Ukraine offensive weapons, as the Biden administration does, that is literally backing Ukraine, absorbing it into NATO informally.

Whether it has signed the contract or not, it is working for; it is a satellite basically of the State Department.

And so Russia says, Look, we’re going to go back to the sponsors. We’re not going to just hit the troops that hit Donbass; we’re going to hit their staging areas. And the staging areas may be to the west of Ukraine.

That’s the message you should have. Russia won’t fight Ukraine; it’ll fight anywhere from Romania to Poland to Germany.

BENJAMIN NORTON: A few more questions here, Professor Hudson, then we’ll wrap up. One is, we’ve seen a lot of reports in the business press recently about how the Chinese economy’s growth is slightly slowing down.

And the last time we had you on, we talked about the property crackdown that was – it seemed to be that Beijing was trying to pop this property bubble before it burst. So there’s been discussion of China’s economic growth slightly slowing.

But other analysts, especially actual experts and not the fake experts who are just actually anti-China activists who are portrayed as experts in Western media – actual experts have pointed out that what China seems to be doing is slightly slowing down growth in the short term, but maintaining stability and also increasing domestic consumption, increasing its economic resilience, so it’s not as reliant on exports.

China and Russia also have been recently in talks discussing building a pipeline and Chinese importing of Russian gas and oil. So it seems that they’re really preparing, being honest, it seems to me that they’re preparing for economic warfare coming their way in the years to come.

It seems that they understand that the years to come are going to be difficult, and they’re preparing for the storm, if you will. Do you agree with that analysis? And what do you see China doing with its economy?

MICHAEL HUDSON: Well, I agree with the analysis. When I was in China 10 years ago, I was lecturing the students. I was very impressed by the fact that they said, already at that time, there was a lot of corruption in China, because it achieved growth by letting individuals make as much money as they can. And some people have made an enormous amount of money, and we’re going to change that.

Well now they’ve grown up. Ten years later, they have risen within the Communist Party. And this year, there is going to be a very major Communist Party Central Committee meeting that is going to announce a new plan forward for China, the general prosperity plan.

And the plan is to have prosperity for the 99%, not the 1%. And just as China has been closing down the Ant billionaires and the real estate billionaires, it’s now moving to essentially cut the wealth of the 1% and promote the wealth of the 99%.

And you can see its success in doing that with the Covid epidemic. There’s hardly any Covid there compared to other countries, because it’s able to shut down, because its economic institutions are not aimed at making a profit, if they’re state financed, they’re aimed at helping the economy grow.

And that’s the difference between socialism and America’s finance capitalism.

BENJAMIN NORTON: Professor Hudson, if I can jump in for a second, I want to point out that, in 2021, two people in China died of COVID. Two. In the U.S., over 400,000 died of COVID. So it says everything about those priorities.

And I also want to mention, you were talking about this shift in emphasis in China, they refer to it as common prosperity.

MICHAEL HUDSON: Common prosperity. That’s exactly the program. And that’s what they’re really aiming at. And they’ve been preparing for that, and putting administrators in place for the last few years.

And most of my lecturing in China is all about a tax policy to essentially prevent the kind of real estate bubble that you have in the United States by taxing away the land rent, so that it won’t be pledged to banks for credit.

So China is moving much more to make the shift the central planning away from the banking system back into the government for government purposes of increasing prosperity.

And of course, you mentioned the big pipeline that they’re developing with Siberia. That’s going to take about four years to build, but it’s going to make, essentially, Russia and China can be almost independent of Western Europe.

Western Europe wants to remain a satellite of U.S. policy. Then Western Europe will go the same way that the United States is going. It’s going to be left out of all of this prosperity that is being created by the Belt and Road Initiative and by the fact that China is able to revive its economy. And even Russia is developing is broadening its economic base.

BENJAMIN NORTON: And finally, to conclude our interview today, Professor Hudson, I want to point out an incredible article that was just published in Bloomberg. I have been sharing this a lot and commenting on it because it says so much about the U.S. government and the U.S. economy.

This is published in Bloomberg. It was published on December 29. It is titled “[Kamala] Harris Quietly Taps Wall Street, Tech CEOs for Advice on Policy.” And that’s pretty euphemistic.

VP Kamala Harris has increasingly turned to corporate executives from Wall Street and Silicon Valley to serve as informal advisers, policy allies and political boosters.

Basically, what the article reveals is that the US vice president is working directly with executives from large corporations to create policy.

And I’ll just read a few paragraphs here: “Vice President Kamala Harris has increasingly turned to corporate executives from Wall Street and Silicon Valley to serve as informal advisors, policy allies, and political boosters as she grapples with a sprawling and at times intractable policy portfolio.”

They mention executives from Microsoft, Cisco, and Citigroup, Citigroup being one of the major banks we talked about earlier, that received some of the $4.5 trillion in Fed repo loans.

So do you want to comment on this revelation? I mean, it’s not surprising, but this revelation from Bloomberg that the US vice president is farming out her policy to executives from large corporations.

MICHAEL HUDSON: It sounds like she is looking for campaign contributions to me, and saying, you know, I will continue to pay attention to you if you give me enough campaign funding that I can get elected over whoever the rival is going to be.

>But I mean, she has to do something with her time, and she is trying to just pacify big business on behalf of the Democratic Party and the Biden administration.

So it just sort of pacifying, saying, we’re on your side. Forget what we put in our platform. Forget the campaign contributions between us. I’m on your side, not the voters.

BENJAMIN NORTON: Great. Well, on that note, before we leave, there are a few comments, super chats with a few brief questions and then we can conclude here.

This is from a Taste of Bass. Thanks for the super chat comment. They said, “Can you ask Professor Hudson about bitcoin? A lot of bitcoin promoters have been using Super Imperialism in their, I’d say, fallacious arguments.”

What do you think about bitcoin?

MICHAEL HUDSON: I don’t like it at all. I have nothing to do with it, and I just avoid all discussion of it even. You might as well buy Andy Warhol etchings.

BENJAMIN NORTON: Yeah we’ve asked you this before and you said it does seem to me that it’s just a bunch of speculation. And not only is it a bunch of speculation, but it seems to be a pretty unreliable investment considering how much the price fluctuates month by month.

MICHAEL HUDSON: Well, let’s look at what they’re speculating on. They’re speculating on that the great growth industry of our time is crime, is drug dealing and its crime. And the criminals use bitcoin. And as they get richer and richer and put all the criminal savings into bitcoin, the price is going to go up and you can make a profit riding the crime wave.

BENJAMIN NORTON: All right, well, I want to thank everyone who watched, everyone who commented. Like always it was a great discussion with Professor Michael Hudson.

And you can go to michael-hudson.com to check out his articles, his interviews, and I would highly recommend going and reading his book “Super Imperialism.”

And for those who want to who are kind of more visual or audio learners, you can go check out the interview that we did here with Professor Hudson on his book “Super Imperialism.” But I still think it’s important to read the book because there’s so much information in there. It really can change the way you see the world.

So it’s always a pleasure, Professor Hudson. Do you want to plug anything before we wrap up?

MICHAEL HUDSON: I can’t think of anything right now, except my “Killing the Host,” my book on the American economy. I mean, don’t just stop with one book. There are plenty there. You can check on Amazon.

BENJAMIN NORTON: Yeah, his books are excellent. He has “J for Junk Economics,” “Killing the Host,” “…And Forgive Them Their Debts” and others. So definitely go to michael-hudson.com and check those out.

And thanks to everyone, and we’ll see you all next time.

MICHAEL HUDSON: Thanks for having me.

https://www.unz.com/mhudson/what-is-causing-so-much-inflation/