Welcome to Part IV of Running on Empty, my four-part analysis of the Petrodollar system.

Part I of this series explained that the US dollar is the world’s first reserve currency that is not backed by precious metals. Instead it is backed by other people’s oil. Because of a secret treaty between the US and Saudi Arabia, petroleum can only be purchased with dollars. Every country needs oil, so everyone country needs dollars and sells imports to the US to get them. Demand for dollars has made the USD the primary American export, allowing the US to deindustrialize and financialize its economy.

Part II explained how the petrodollar has grossly enriched American asset holders (stocks, bonds, and real estate) and painfully impoverished American wage earners. Under the petrodollar system, dollars are created by private banks for profit. These dollars are recycled into the economy by OPEC nations, causing stocks, bonds, and real estate to rise. This profitable exchange is enforced by American military might, which punishes any country that seeks to exit the petrodollar system.

Part III explained that for the petrodollar system to function, America needs to be able to project power worldwide to secure international trade and enforce the system. America secures global commerce and projects military power by commanding the World Ocean, by which 90% of all goods are trafficked. To overcome America’s naval supremacy, both Russia and China have sought to establish control of the World Island, the Eurasian supercontinent that houses most of the world’s population and resources. The Russo-Ukraine War is a proxy war between the uncontested master of the World Ocean (America) and the would-be masters of the World Island (China and Russa).

In Part IV, we’ll discuss how faulty expectations by both sides in the Russo-Ukraine War have led to sanctions of such severity might cause the petrodollar system to break down.

Strategic Goals

Going into the war, each of the various great powers had its own long-term and short-term goals.1 My assessment of these is as follows:

Russia’s long-term goal is to establish itself as the leading World Island power with a wheat, oil, gas, coal, and steel trade that runs from Pacific to Atlantic. Its short-term goal is to stop the eastern advance of NATO and EU blocs.

China’s long-term goal is to establish itself as the leading World Island power with a Belt & Road network that runs from Pacific to Atlantic. Re-taking Taiwan is seen as indispensable to this. Its short-term goal is to weaken the United States.

America’s long-term goal is to maintain its hegemony. To do so, it believe it needs to keep Russia down, preferably split into a bloc of smaller nations that will be easier to control, it needs to forestall China’s rise until the regime falls or weakens.3 In this way, the World Ocean power will remain dominant, its currency regime will continue to enrich the American elite, and the world order will stay in place. Its short-term goal is to continue the eastern advance of NATO, to weaken Russia, and to deter China from foreign adventure.

Ukraine’s long-term goal is to join the European community, maintain its territorial integrity, and support the American effort to break Russia down.

Europe’s long-term goal (to the extent a unified Europe can be said to exist) is to transform into a continent-wide social democracy, protected by the hegemon, powered by renewable energy, and occupied with a myriad of diverse affluent citizens governed by a wise technocracy. Europe’s short-term goal is to sustain its economy and its progressive regimes.

Expected versus Actual Outcomes

Russia launched what it called a “special military operation,” and NATO called a “full-scale invasion” of Ukraine on 24 February 2022. What did everybody expect to happen?

Russia believed that Ukraine would quickly collapse. The Russian army would secure the territory of the Donetsk and Luhansk People's Republics, which could later be integrated into Russia. If the initial assault was effective enough, the capital might fall and the pro-American ruling regime collapse; it could then be replaced by a pro-Russian regime. Faced with a fait accompli, the world would accommodate itself to the new reality, as it had after Russia’s prior actions in George and Crimea.

China believed that Russia would succeed. Russia’s success would, in turn, demonstrate that the West is a “paper tiger” that cannot stop a strong and determined power willing to exercise its might. If Russia was successful enough to claim a decisive victory, this might position China to re-take Taiwan.

America and Europe believed that Ukraine would collapse, but not too quickly; it would hold out long enough for a series of devastating sanctions to economically cripple Russia. Faced with the prospect of economic isolation and impoverishment, Russia would come to the negotiating table to work out a deal. The deal would leave Ukraine with its territory intact but deny it NATO membership. If the sanctions hit hard enough, Putin’s regime might collapse; it could then be replaced by a pro-Western (or at least pro-globalist) regime.

Ukraine believed that it would hold out against Russia long enough for a combination of American sanctions and military aid to force Russia to the negotiating table for a deal, as above.

Those were the expectations. What was the reality? If you’ve been following the war, then you know what happened: Everybody was wrong about everything.

Russia was wrong because Ukraine did not quickly collapse under the weight of Russian military might. It didn’t collapse in days, nor in weeks, nor months. It didn’t collapse at all. Ukraine actually pushed back Russia in the northeast, and held its ground against Russia in the southeast, inflict great cost in men and material. Far from winning easily, Russia has suffered casualties not seen in European warfare since WWII.

But America, Europe, and Ukraine were also wrong! Russia’s economy did not quickly collapse under the weight of Western sanctions. Economic pain didn’t bring Russia to the negotiating table with America and Europe — it forced Europe to negotiate with Russia for oil and gas. And as the war drags on, the sanctions continue to hurt the West more and more.

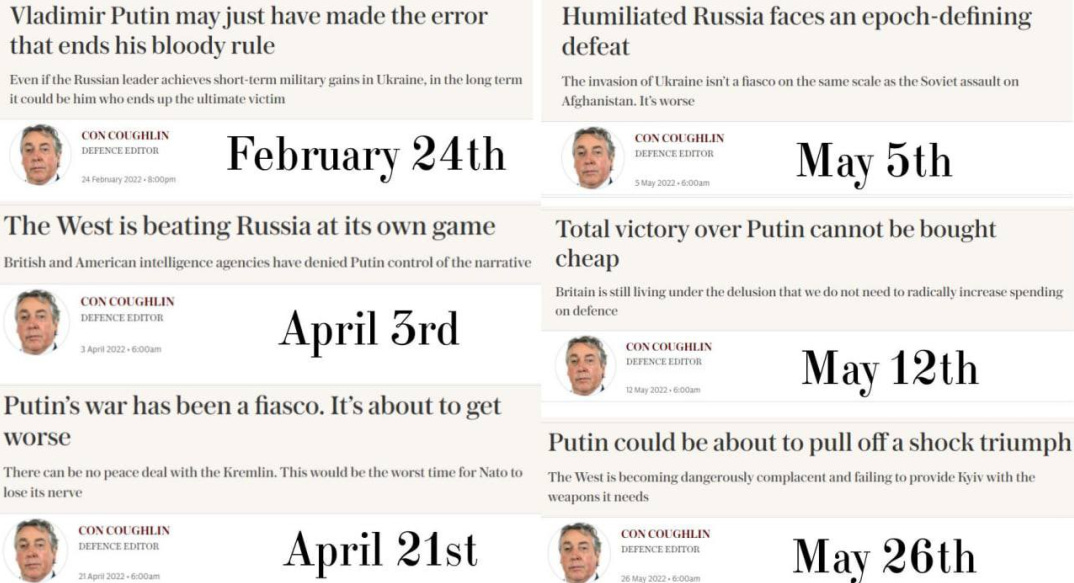

Russia seems to now be on the verge of doing to Ukraine in June what it thought it would do in March — crushing it. Now, it looks like Russia might win in Ukraine after all, and without coming to the negotiating table. The shock this turn of events has caused in our journalist class can be seen by tracing the headlines:

But Putin’s “shock triumph” won’t be the taking of the Donbas. The shock triumph will be the destruction of the petrodollar at the hands of the very sanctions intended to maintain it.

Suicide by Sanction

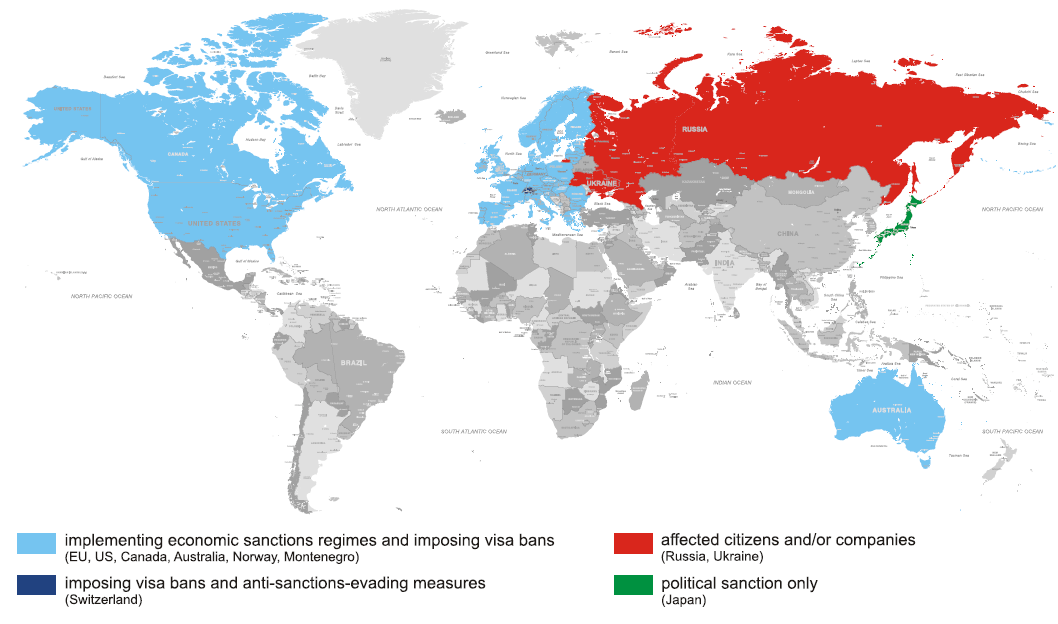

The Peterson Institute for International Economics reports that “Russia's military assault on Ukraine has prompted other countries to impose an extraordinary set of coordinated economic sanctions against Russia. The measures aim to limit customary trade and financial relations with Russia, penalize Russian oligarchs for supporting Putin and potentially cripple Russia's economy, all in hopes of… deterring Putin from… continuing acts of war.” PIIE has tracked and tabulated a full list of the sanctions, annotated by date and country. We’ll summarize the list here.

Over the last 90 days, the West has:

Banned Russian banks from using the SWIFT financial system2, the primary means by which international transactions are handled worldwide;

Banned imports of Russian oil, natural gas, and coal into the US, UK, Canada, and Australia;

Banned export of industrial, high-tech, and dual-use goods from the West to Russia;

Divested investment by US, UK, and EU countries into Russian oil and gas;

Frozen the assets of Russia’s largest banks, as well as hundreds of Russian politicians and oligarchs and many of their family members;

Prohibited transactions with the Russian Central Bank, the Russian Ministry of Finance, and Russia’s sovereign wealth funds; and

Prohibited Russian ships from docking, Russian trucks from using the roads, and Russian aircraft from flying, in US, UK, or EU territories.

Russia, meanwhile, has responded with counter-sanctions. Russia has:

Banned Russians from transferring foreign currency abroad, including servicing of foreign loans;

Banned exports of grain to its Eurasian Economic Union partners;

Blocked transactions with foreign energy companies;

Decreed that natural gas payments must be made in rubles if the buyers are from unfriendly countries, including Western Europe. Russia supplies one-third of Europe’s energy; and

Shut off natural gas exports to Bulgaria, Finland, and Poland over their refusal to pay in rubles.

On first glance, the Western sanctions seem monolithic and overpowering and the Russian sanctions narrow and weak in comparison. Indeed, the Washington Post called the sanctions a “financial nuclear weapon,” and the unanimous expectation was that Russia would utterly crumble.

Had Russia crumbled, the dollar’s hegemony would have been assured for another generation. A humiliated Russia would have toppled Putin from power and exited Ukraine; the sanctions would have been lifted; Russia would have re-entered the world financial system; and China would have been suitably cautioned not to “fuck around and find out.”

That’s not what happened. As Global Times puts it, “after two months, the effect of the sanctions has failed to meet the expectations set by Western countries. The exchange rate of the Russian ruble has returned to or even exceeded the level before the sanctions, the bank run has basically disappeared, and the performance of the Russian capital market has stabilized.”

The reason the sanctions failed becomes obvious when you look at what didn’t get sanctioned. The EU didn’t ban oil and gas. Instead it just ordered that imports of Russian oil be “phased out” over the next 6 months, with an exception beyond that for EU states that "suffer from a specific dependence on Russian supplies and have no viable alternative options.” The EU has not banned natural gas imports at all. It can’t. Europe has decarbonized and denuclearized so much that it is utterly dependent on Russian power. Russia supplies Europe with 40% of its natural gas. If it does not have Russian gas, Europe freezes.

When Russia demanded payment in rubles for its gas, the EU responded with shock and outrage, called Putin a blackmailer, and refused to cooperate. After Bulgaria, Finland, and Poland had their gas shut off, the EU decided it would pay for natural gas in rubles. As a result, the ruble has now become one of the most successful currencies in the world. Now the “gasruble” (to coin a word) is competing with the “petrodollar” as a currency for global energy transactions.

This is a truly seminal moment. Vladimir Putin is essentially the first world leader to defy the petrodollar successfully. Not only is the EU now buying Russian gas in Russian rubles, the rest of the world has largely remained open to trade with the Bear. As it turns out, the “global community” actually only includes the US, UK, EU, Canada, Australia, and New Zealand. Of the world’s 10 most populated countries, only one (the US) joined the sanctions. India, Indonesia, Pakistan, Brazil, Nigeria, Bangladesh, and Mexico did not. (If only there were some word we could use for that portion of the globe that is neither part of NATO or Russia.3)

Russia’s trade relations with the world have enabled it to bypass the sanctions on its oil. Russia simply ships its oil to nations such as China and India, who then refine it and ship it to whichever country would like to buy it. The US cannot sanction the grey areas on the map without wreaking further havoc on the global supply chains.

Russia and China smell blood in the water. Before the Russo-Ukraine War, both had already created competitors for the SWIFT system. Russia had established the System for Transfer of Financial Messages (SPFS), a ruble-based payment system, as an alternative to SWIFT. China had launched the Cross-Border Interbank Payment System (CIPS) as a renminbi-based system. Now they plan to expand them. Eric Johnson, writing for Global Finance, notes:

A December report by the Hong Kong-based consultancy Dezan Shira & Associates cited “plans to integrate” CIPS and SPFS. It also said the Russian government was in talks to expand SPFS to Turkey and Iran. Tim White, a Special Advisor on Sanctions at AML RightSource, a financial compliance specialist, says Russia may seek to expand its SPFS system to other non-NATO players in light of the Swift ban… “[C]ountries will be drawn to using other currencies and payments and settlement systems that fall outside American control.”

China, India, Russia… These are the nations of the World Island and they now fall outside American control.

What Happens Now?

There no longer seems to be any reasonable prospect of returning to the pre-war world order. The Russo-Ukraine War has triggered a new Cold War with the “Free World” of the US, UK, and EU up against the “Former Communist World” of China and Russia. This is, of course, exactly the World Ocean versus World Island confrontation that the US didn’t want to happen.

It’s happening.

That’s clear. What’s less clear is what that means. Who will the Third World side with? That is, will Brazil still buy oil in dollars? Will Nigeria still sell oil in dollars? Will BRIC nations still export us goods in exchange for greenbacks? Will the US be able to sustain its global trade deficits, offshore its inflation, and continuously inflate its assets?

The Western elite is confident that the Russo-Ukraine War will not hurt the importance of the dollar or euro. Yesterday the European Central Bank released a report to reassure everyone that things are just peachy for the currency:

The barrage of sanctions -- including the freezing of Russian central bank assets and the expulsion of private lenders from the SWIFT messaging network -- has fueled speculation that some nations may seek to bypass the euro and the dollar in the future, for example by boosting their holdings of renminbi, gold and crypto-assets, according to the report.

But those alternatives “often lack the depth, liquidity or other economic and financial attributes required to appeal to global investors,” the report said. And while the dollar’s share in global reserves has declined, its importance remained stable or even increased in other areas like bond issuance, it said.

The Chinese seem to believe de-dollarization is, if not at hand, at least in sight. Xu Wenhong, a research fellow at the Chinese Academy of Social Sciences, writing for Global Times, says:

Western countries take advantage of SWIFT's dominant position in the international financial system, weaponize it, and abuse the public good in the international financial field to attack other countries, resulting in falling trust in SWIFT and the emergence of more alternatives. At present, some countries have developed several alternative systems similar to SWIFT. In the future, the international payment system may be built on multi-system coexistence and regionalization, which will also accelerate the process of "de-dollarization" on a global scale.

Dissident thinkers are, shall we say, less sanguine about things. Market Ticker’s Karl Denninger speaks with his usual blunt candor:

The so-called Russian Sanctions have blown up spectacularly in the western world's face. Russia now has a stronger currency than it did before the war we instigated began. Oil and Natural Gas, never mind things like fertilizer, are nice and expensive which suits Putin just fine. He has negotiated long term interchange with China for both and is building out the capacity to wildly increase same. Europe is fucked down the road as a result and in the meantime they got nothing for all these "sanctions."

For that matter so are we. We've sequestered our inflationary deficit spending4 overseas via the China/US (and other nations, including India) trade deficit for the last two decades. That's over and will never come back because none of the nations that we were doing it with have any reason to allow it ever again and they don't need to… As a result we can no longer spend in deficit without it reflecting back into inflation which means the "free ride" gave has been terminated and while this was always eventually going to end we did this to ourselves and thus the inflation you're seeing and will continue to see was and is caused directly by our policies and our government.

Thus the only way to stop the inflation is to stop deficit spending -- all of it -- right now…

We had better reverse course on all of our insanity with regard to energy now -- including oil, natural gas and especially coal, which has a stable long-term price structure or we're going to get fucked. The economy here will fold back into a deep, nasty inflationary recession materially worse than the Carter Stagflation…

Further, we can no longer spend, at the federal level, anything we do not first tax from someone. I do not give a wet crap what the excuse is from the left or right it all stops now or we will continue to get a wild inflationary spike, demand destruction will inevitably follow and so will severe civil unrest when the blackouts start along with the inability to fund food or even worse -- civil war.

I agree with Mr. Denninger. In a sense, this four part essay series was my attempt to explain, in depth, why one ought to agree with him — to show how the petrodollar system had come to be created, what its effects had been, how it forced us into a particular geostrategic position, and how our attempt to maintain that position had backfired into the destruction of the system.

We should not mourn this. The petrodollar system was corrupt from its inception — built on other’s people’s resources, made for profit by our private banks, enforced by military might on the rest of the world. The petrodollar system created a new gilded age, made homes unaffordable to wage owners, and deindustrialized what was once the world’s most powerful manufacturing base. It left America running on empty. And now it will stop. The only question is whether that stop will be a slow brake or a crash, and how best we can get started again afterwards.

Let’s acknowledge here that reality is not so clean as a Tree of Woe essay might wish. America, China, and Russia each have many different politicians and parties operating within them, and Europe has many from each country. Each and every one of those politicians and parties is pursuing different goals. I have presented what I believe to be the strategic goal of the permanent bureaucracy or deep state of each faction. For instance, there are obviously some Europeans who oppose social democracy or would prefer less European unification rather than more, but the EU “deep state” seems to be committed towards tighter unification, more technocratic socialism, etc.

SWIFT is the Society for Worldwide Interbank Financial Telecommunication, which operates a messaging network that banks and other financial institutions use to transfer money. There are 11,000 SWIFT members (banks) worldwide.

Hurray. We’ve re-invented the Third World.

See Parts I and II of this series if you don’t understand how the petrodollar system has enabled us to offshore our inflation.

https://treeofwoe.substack.